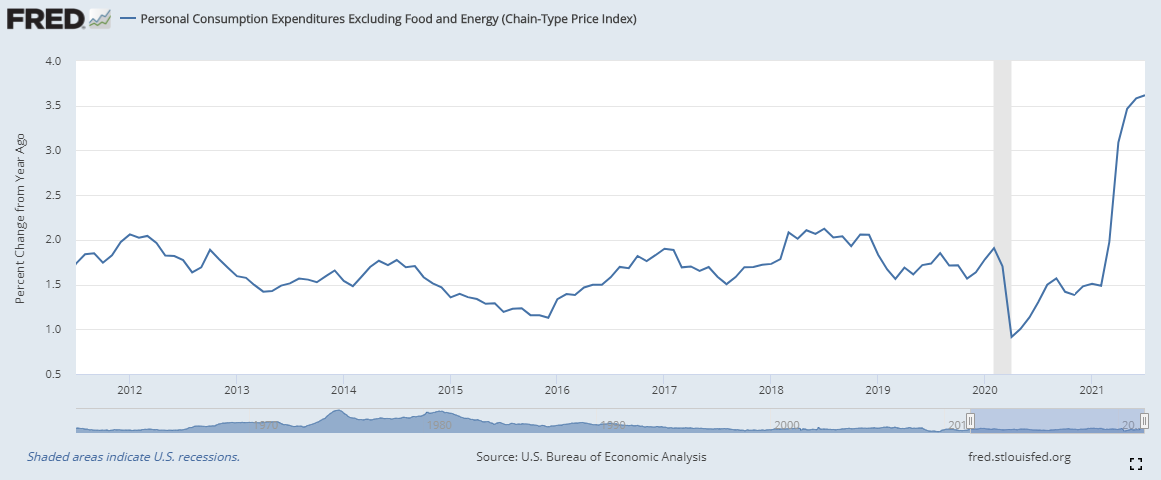

Moving the goalposts is a time honored tradition among those in the seats of power and the Fed is not immune to this. Today Fed Chair Jerome Powell spoke about monetary policy. You can listen to it yourself here. At 22 minutes, it was one of his shorter speeches. Nothing that J.Powell spoke about was a shock. He highlighted that employment is still lagging from the pre-pandemic lows and that the Fed is closely monitoring inflation expectations. In fact, he spent a considerable amount of time talking about inflation. He provided this graph when he did so:

The funny thing about this graph is that the core PCE inflation data is based on a percent change from 18-months ago. When you go to the Fed’s website to replicate this, they only allow a 12-month percent change.

There is a considerable difference between these two graphs. Did the Fed modify their preferred inflation tracker to moderate the change in inflation? Government statistics are easily manipulated. Often they are manipulated to fit a predetermined conclusion. This seems like it could be one of those times.

Mr Powell also spoke of tapering asset purchases. This was his strongest emphasis of tapering asset purchases to date. He even indicated that the process could start before the end of the year. The market’s reaction to this was as if Jerome had made the most dovish statement to date. The market shot up, yields on bonds shot down, and the dollar headed lower. This would have been absolutely bewildering to those that thought we would have a taper tantrum.

As I indicated yesterday, there will be no taper tantrum this time around. The market is prepared for the Fed to remove their accommodative policy of US treasury and mortgage-backed security purchases. In fact, I think the market has been ready for this for some time now. By waiting so long to act, the Fed is risking losing control of monetary policy. If this were to happen, they would have a very difficult time getting back into the driver’s seat.

As for now, my recommendation is that the general market looks stable. Oil is in a short-term bear market. I believe this will reverse as the spread of the delta variant lessens and China eases their restrictive lockdowns. Gold and silver are cheap but are also mired in a bear market. Soft commodities (wheat, corn, soybeans) are running similar to oil. They were real hot but have cooled and now are in a short-term bear market. Short term investors should be concentrating on oil and the general market. Longer term investors should be focusing on gold, silver, and the soft commodities.

As a heads-up, I will be off next week Monday and Tuesday. So enjoy your weekend and I’ll see you back here on Wednesday.

I always see CPI as part of the scam, although certainly if you start seeing broad price increases past a 2% target then thats quite a heavy devaluation. Higher wages enable CPI. In the UK its been about 3.5% and this was the same in the US as well until after 2008 when it went down to 2% growth. What truly enables the iniquitous inflation tax is that products have truly become cheaper, but the give away is that property of course tracks inflation. Its my pet peeve that wage inflation always takes second place to CPI when considering underlying actual growth in the money supply.

Anyway, that aside, when the Fed *indicates* (not do) its going to taper its clear to see that yields would reduce in anticipation. BUT this is not an actual taper. Actual tapering is an end to yield manipulation i.e. fake taper+yield control=lower yields but actual taper+no yield control is entirely different. Nobody knows what the market rate for yields is. I think its very likely that the market yield would be much higher and that the tightening of policy which should lower yields will be overwhelmed by real market pricing. So I personally think that indicated taper and actual taper are two extremely different beasts, and that the Fed will find that tapering does cause a panic and it is indeed now trapped. Its very easy for Powell to essentially game expectations but the reality is that he is bluffing his way for stability through a period of dollar devaluation. If tightening causes yields to rise then clearly this is to lose control of the monetary levers.