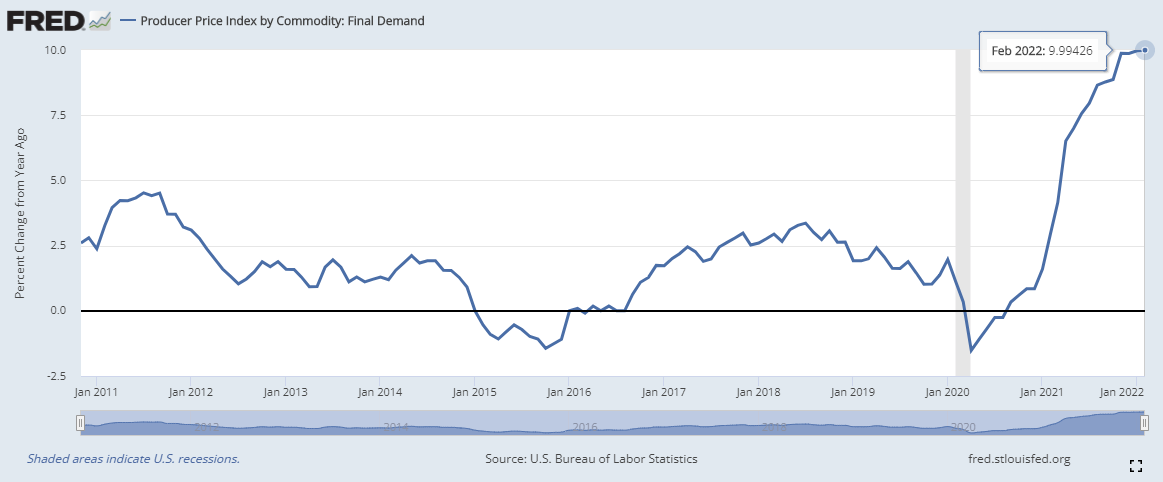

Federal Reserve Chairman Jerome Powell did it. He got us to double digit inflation. The PPI dropped today at it came in at 10.0%!

The Producer Price Index (PPI) increased 0.8% month-over-month in February. This is less that the revised 1.2% jump in January. The big contributor to the increase was a 14.8% rise in gasoline costs. Still, February didn’t capture the entirety of the move in the oil price and now the oil price is moving back down. No compromise has been made between Russia and Ukraine. The US is still sanctioning Russian oil. In addition, the fundamentals of oil have not changed. This includes the lack of new well development and capital expenditures. No new capital is flowing to oil projects. Many have been cut off by the ESG movement. This will ensure that the price of oil will stay high.

So why the move lower? Hedge funds are beginning to unwind positions. This was covered by John Kemp at Reuters.

That big stick lower is hedge funds taking profits. There are still many holding onto positions.

However, the net position is coming down. Oil could fall further but make no mistake, this is temporary. As I stated above, without further well development and drilling in the US, oil will stay very tight. OPEC+ is at or near their capacity. All of the Biden administration begging has yet to produce an additional barrel from Saudi Arabia. Swapping over to importing Venezuela is not going to solve the issue as the Venezuelan oil is very dirty and takes an advanced process to get it to refine-able quality.

Finally, Joe Machine continues to run afoul of the Biden administration. This time in Biden’s pick for the Federal Reserve Board, Sarah Raskin. I’ve briefly detailed Ms Raskin’s views on restricting capital to industries that cause climate change. Apparently Senator Joe Manchin feels the same way I do. He stated this plainly when he said,

“I have carefully reviewed Sarah Bloom Raskin's qualifications and previous public statements. Her previous public statements have failed to satisfactorily address my concerns about the critical importance of financing an all-of-the-above energy policy to meet our nation's critical energy needs. I have come to the conclusion that I am unable to support her nomination to serve as a member of the Federal Reserve Board.

This was a bigger announcement than most gave it credit for because Senator Manchin isn’t even on the Senate Banking Committee. Since Ms Raskin’s nomination hasn’t even made it out of committee, this is certainly a major blow to her nomination.

Senator Pat Toomey is the Senate Banking Committee’s top republican and has been leading a boycott of the vote to advance Ms Raskin’s nomination. The chair of the commmittee, Sherrod Brown of Ohio, had refused to hold separate votes on the nominations, which include the reappointment of Jerome Powell as chairman and Lael Brainard as vice chair.

LATE BREAKING NEWS

President Joe Biden has withdrawn Sarah Bloom Raskin’s nomination for the Federal Reserve Board.

Manchin*, but he has been quite the machine this past year! LOL