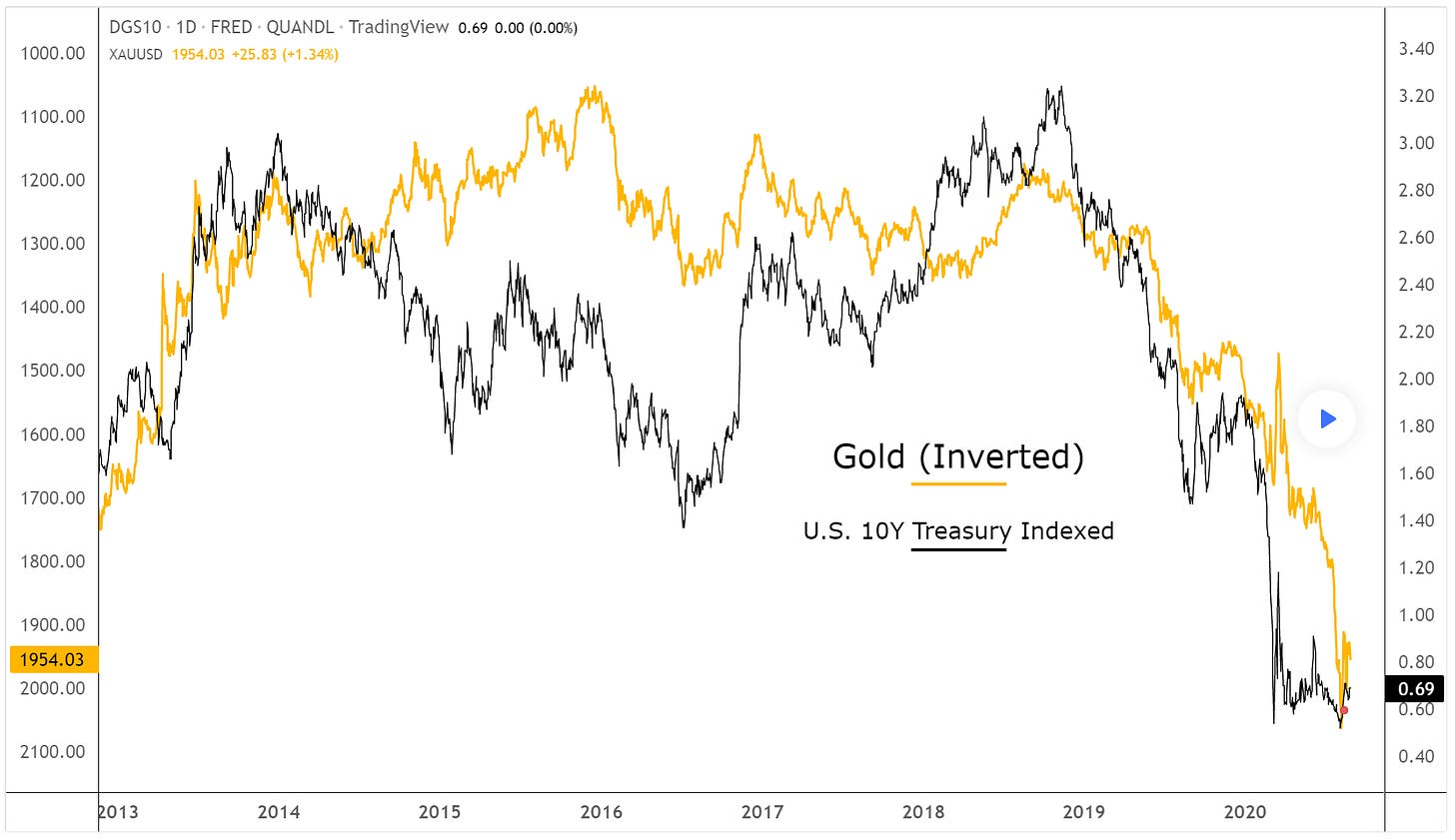

The FOMC minutes that were released yesterday are continuing to put pressure on interest rates. This is having profound effects on the market. The big indices are treading water while oil has shot through the roof. The exception is the Russel 2000 (IWM). This is because the banks and oil companies make up a large portion of it. Oil is having a tremendous day, CLR especially. We are seeing gold getting heavy selling pressure as it tracks the inverse of the 10-year treasury so closely.

The market is still adjusting to the idea of the Fed’s first rate hike. There is a rotation happening from unprofitable growth stocks into value stocks as traders try to gauge how serious the Fed is about reducing their balance sheet.

The Fed’s balance sheet has ballooned to $8.7 trillion. The last time the Fed attempted to reduce the size of their balance sheet was October 2018 through August of 2019. They reduced their balance sheet by $710 billion which was just under 16% of their total balance sheet. At the end of the 11 month experiment in balance sheet reduction, the Fed quickly ended the practice and began expanding once more.

We are now seeing the Fed talk the talk but when it comes to walking the walk, I don’t believe they will have the backbone to allow the market to correct.

Tomorrow we’ll see the release of the unemployment rate and the labor participation rate. Jerome Powell, chairman on the Fed, has stated that he is watching the labor participation rate closely. I believe he is saying this to give himself cover to delay raising interest rates. In addition to this employment news, Fed presidents Daly, Bostic, and Barkin all are slated to give speeches. I’m doubtful any new revelations will be shared.