The Consumer Price Index was posted this morning. Anyone expecting it to moderate or go down was very disappointed.

The US annual inflation rate hit 7.9% in February. This matched the market expectations. Here is the month-over-month heatmap from the BoA Global Research team.

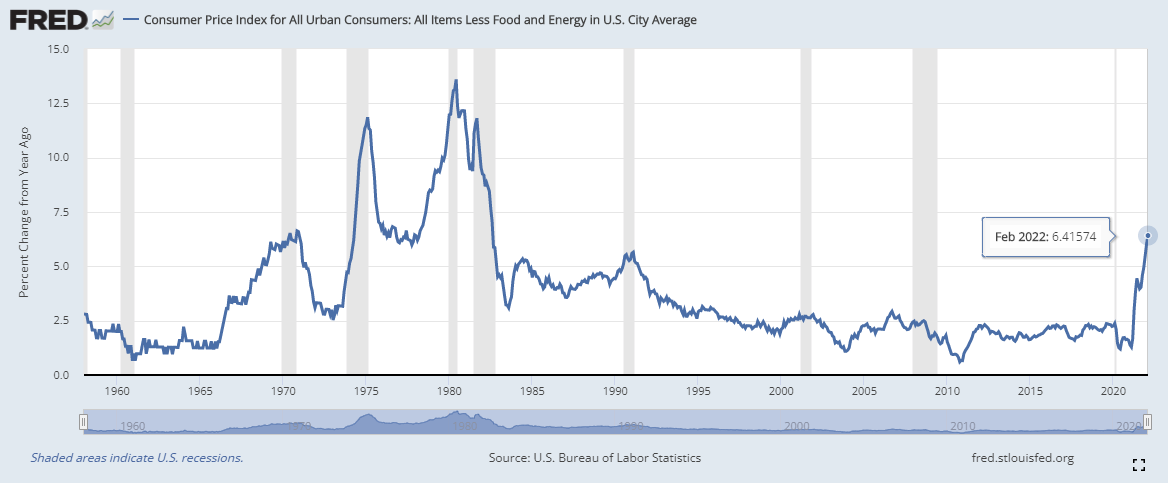

Energy remained the biggest contributor with gas prices at the pump at nosebleed levels. Inflation is also continuing to accelerate in the housing/shelter department. Finally food is also beginning to run very hot. Though food and energy were hot, the ‘core’ CPI without them showed no signs of slowing down.

This shows that the gains in the inflation rate continue to be broad based. The inflation rate continues to maintain its blistering pace with the headline figure gaining 0.8% and the ‘core’ up 0.5% on a month-over-month basis. Sadly, the Fed continues to slow walk any action to contain it.

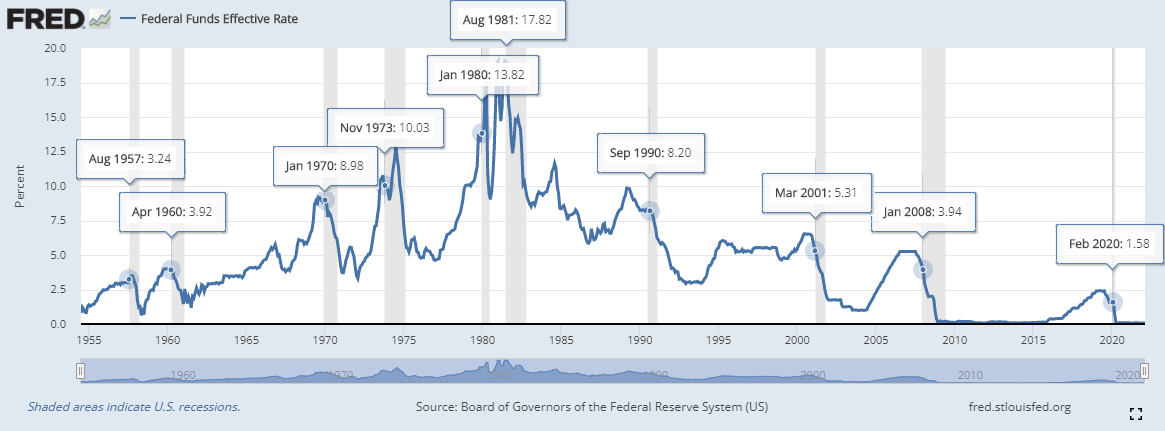

The latest from Fed Chair Powell is that the Fed will raise rates 25 basis points to .25% at their March meeting. The announcement will be formally made Wednesday. An increase this paltry will not be enough to meaningfully slow the inflation rate. At the same time, we are running headlong into a recession.

At the beginning of the year, the 10-2 Treasury spread was at 85 basis points. We are now down to 26. There is still time to correct this but the motivation to do so is lacking. The Fed is in no rush to do anything and the Biden administration is more concerned with our carbon footprint. The US is on the cusp of experiencing a recession and when it does, the Fed will have no room to cut interest rates to spur on demand. This will be the lowest the Fed funds rate has ever been when a recession has started.

The administration is attempting to shift the blame of inflation onto the Ukraine-Russia conflict. While there is some truth to this due to oil and wheat prices spiking, the primary reason is the Fed’s monetary manipulation. If both sides in the conflict are able to come to a ceasefire agreement, we may see a pullback in the safety trade of SOG (silver, oil, gold) and a S&P500 rally. If the fundamentals of the situation don’t change, this pullback and rally will be short-lived.

Year-over-year heatmap

The sad thing is, gasoline and other commodity spikes really didn't start in earnest until March. The next YoY number will be epic, probably pushing deep into 8% range. March '21 was 0.6% increase MoM which is easy to beat. I expect to hear a lot more of Biden's phrase "Putin's price hike" as if inflation wasn't a problem before the war.

Really not sure what to expect regarding recession. Money supply, margin, and treasury yields have cooled off slightly. But the economy is re-opening, and now there is war drama. I think a lot of choppiness is in order, so if my SPY leap goes back in the money I'm probably dumping it.