Trading commodities has become a death trap for money looking for a return. Looking at TradingEconomics splash-page for commodities, its a sea of red.

This is typical positioning for a recession. The ups and downs of the economy are very important in determining the rise and fall of corporate profits. This goes hand-in-hand with a slowdown in GDP. Business sales slump, corporate profits contract, GDP slows down.

GDP is a sloppy way to look at the economy but it is a statistic that many use. When investors anticipate a slowdown, they sell industrial raw materials, components, and associated companies. When GDP slows, it is a sign that business sales are slowing and corporate profits are contracting. In response to a reduction in sales, businesses begin ordering less raw materials such as chemicals, metals, plastic, oil, gas, wire, and semiconductors. They also begin to reduce staffing. Everyday necessities such as food, beverages, and medicines are largely exempt however, people do trade down during recessions by buying cheaper food and eating at home. With this said, is a recession really coming?

Unfortunately, Janet Yellen has killed one of the keys to understanding if we are truly facing a recession due to her incessant operation twist at the Treasury. Janet has been busily selling 2y bonds and buying 10y bonds which has distorted the yield curve.

I saw this quote from the MacroTourist and I felt that it fits our current situation:

Another factor that can give insight into potential economic slowdowns is durable goods. These are big-ticket items like cars, appliances, and factory equipment that can be highly responsive to changes in the economic cycle.

Do durable goods say anything? We could be seeing a near-term peak. Year-over-year numbers are still positive. So that leaves employment.

This week saw a big data dump on employment figures. Here is the summary:

JOLTs job openings surprised to the upside

JOLTs quits met expectations

ADP Employment surprised to the upside

Non Farm Payrolls surprised to the upside

The Unemployment Rate was higher than expected (3.7% actual, 3.5% consensus estimate)

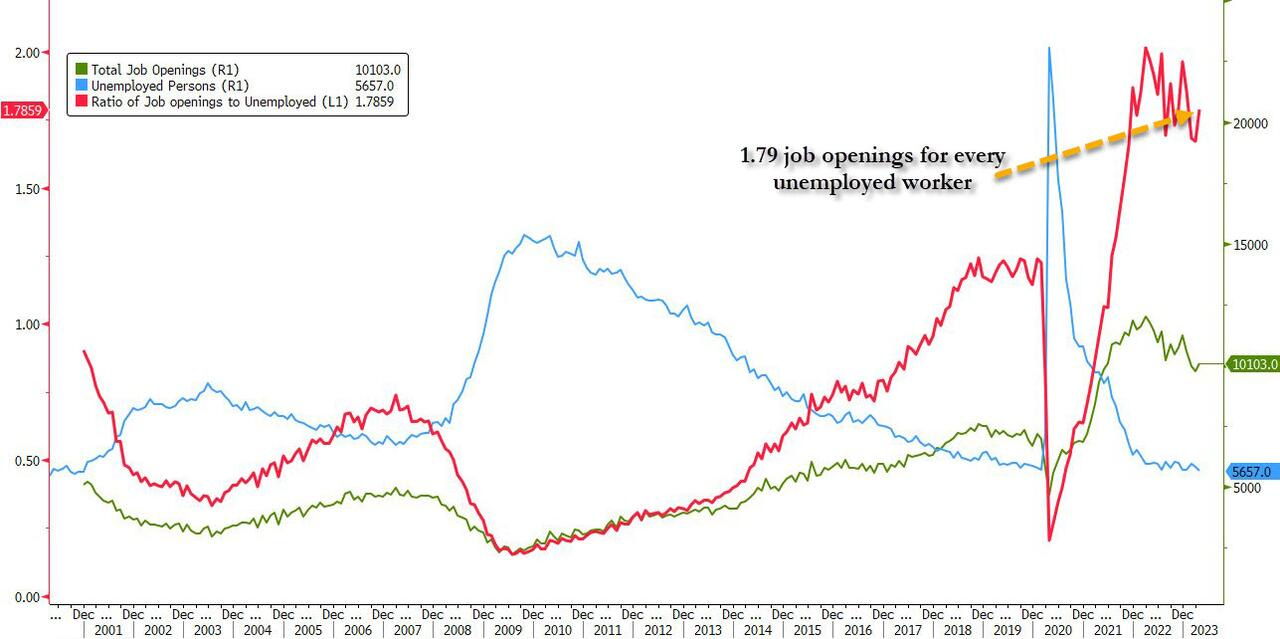

While the unemployment rate rose 0.2% over the previous month, employment still looks tight. We have 1.79 jobs for every unemployed person.

Danielle DiMartino Booth put best.

Investors are positioning for a recession and the numbers that are coming in show us in a recessionary trough, yet unemployment continues to be held in check.

At the same time, we are seeing nationalization of mining operations take place in Namibia.

"We are making a case that local ownership must start with the state, which holds ownership of our natural resources," Minister of Mines and Energy Tom Alweendo told lawmakers at a parliamentary workshop on Monday.

"The proposed state ownership should take the form where the state owns a minimum equity percentage in all mining companies and petroleum production, for which it does not have to pay."

The key phrase here is “does not have to pay”.

Next to Kazakhstan, Namibia is one of the biggest uranium producers in the world. They are also known for producing diamonds and have significant lithium deposits.

Does this mean that uranium could be making a comeback?