The Fed has fallen into a trap of their own making. Since the birth of QE, after the 07-08 “great recession”, the central bank has been busy loading up their balance sheet and printing gobs of money. Globalization took root and the cost of producing goods and extracting resources plummeted. Print as they did and yet no inflation was to be found. The central bank’s big worry, at the time, was deflation (which is something the lower and middle class would cheer about). They then threw caution to the wind and during the down turn in March of 2020, they printed and QE’d with reckless abandon. With lockdowns around the world, we hit peak globalization as supply chains were wrecked. Businesses began to realize that the just-in-time inventory systems had serious flaws. Now the Fed has begun to realize all that inflation that had been pent up. However, I believe they have been telling lies and now actually believe their own lies are truth.

Today the NY Fed posted their survey of inflation expectations. It does not look good.

One year expected inflation has hit 6.6%. Three year expectations are at 3.7%. Both of these are disingenuous. When you delve into the dispersion of results, there appears a glaring error in these numbers. For the one year results, the dispersion was 3.3% to 10.0%. This is a wide scattering of answers from the survey takers. The median point prediction was 8.5%. This is nearly a 2% difference between what the NY Fed posted as an expected inflation rate and what the actual median point was. A similarly wide distribution is found in the three year expectations. Survey takers answered anywhere from 0.0% to 7.9% with the median point prediction being 4.9%.

This tells me that consumers are beginning to anticipate higher inflation in the future and the Fed better be paying attention because inflation expectations are becoming wildly unanchored.

While gold is still a laggard among the public, the categories of rent, gas, and food were all 9.6% and above. This is where the general public is really feeling the pinch of inflation and these survey results show it.

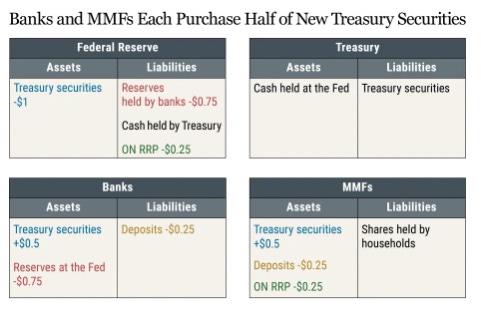

Another thing that caught my eye on the NY Fed’s website was their blog post about “The Fed’s Balance Sheet Runoff and the ON RRP Facility”. This was the Fed’s attempt at displaying how quantitative tightening (QT) will influence the balance sheets of the US Treasury, banks, and money market funds (MMF). While the general accounting principles are easy enough to follow for someone who has had accounting 101, what is missed are adjustments to interest rates and the consequences that would ensue.

The Fed admits here that the primary user of the overnight reverse repurchase facility (ON RRP) has been money market funds. They also believe that when more treasury securities are available, banks and MMFs will cash out their Fed reserves and RRP money to buy them. While this is probable, the analysis is missing how these market participants will react as interest rates rise. When you tell yourself a lie enough times, you begin to believe it. This leads to shortcuts on analysis as seen here. By not taking into account fluctuations in the interest rate, the Fed isn’t being honest with themselves. The balance sheet runoff will have the power to influence market participants down the line. They even admit to it at the end of their blog post.

“As the exhibits in this post show, the runoff of the Fed’s security holdings has potential implications for the balance sheets of a range of financial market participants.”

No mention is made of sovereign wealth funds or other countries that buy Treasuries and how a balance sheet runoff might influence their purchasing decisions. Bond owners beware, treachery and lies are afoot.

Great synopsis as usual. It's really unfortunate how the IT revolution, which has produced some of the most rapid increases in productivity and wealth seen in history, has been accompanied by some of the most sophisticated, aggressive central bank theft as well. Yet, it will end up at the same dead end. How long gold and silver can keep lagging.