Federal Reserve Chairman Jerome Powell spoke at the symposium on Central Bank Independence at the Sveriges Riksbank in Stockholm Sweden today and delivered an uppercut to the ESG/climate investing agenda. You can find his speech in full here. It was a short one and it appears that was intentional. Powell is driving a stake into the heart of the idea that the climate agenda is the responsibility of the Fed.

“It is essential that we stick to our statutory goals and authorities, and that we resist the temptation to broaden our scope to address other important social issues of the day.”

“Today, some analysts ask whether incorporating into bank supervision the perceived risks associated with climate change is appropriate, wise, and consistent with our existing mandates.”

“Decisions about policies to directly address climate change should be made by the elected branches of government and thus reflect the public's will as expressed through elections.”

“But without explicit congressional legislation, it would be inappropriate for us to use our monetary policy or supervisory tools to promote a greener economy or to achieve other climate-based goals. We are not, and will not be, a "climate policymaker.”

While the above alone should be the death knell for the climate commies, what made this speech especially juicy was the references Powell used. Powell incorporated ideas from Bernanke, Stanley Fischer, Kenneth Rogoff as well as juxtaposing the BoE and ECB mandates against the Fed’s mandate.

“While U.S. monetary policy has the dual mandate of maximum employment and price stability, some other central banks have somewhat more expansive mandates. The Bank of England and the European Central Bank both have a primary mandate to maintain price stability but a secondary mandate to support the economic policies of the U.K. government and the European Union, respectively; see the Bank of England Act 1998, part II(11), available from the U.K. National Archives at https://www.legislation.gov.uk/ukpga/1998/11/contents, and the Treaty on the Functioning of the European Union, Article 127(1), available from the European Union at https://lexparency.org/eu/TFEU/ART_127”

This all ties together with Powell’s raising of interest rates. When interest rates were 0%, the time value of money equation was turned on it’s head. This caused projects like the climate-agenda/ESG and the like to find funding. Growth projects that promised future profits at the expense of today’s dollars look like home-runs. Now the tide is moving out and we are beginning to see who was swimming naked.

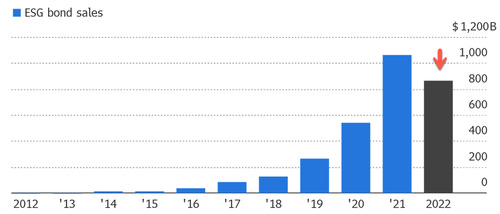

Zerohedge recently reported on this but from a different angle. What they saw was that ESG linked corporate bonds were on the decline.

Capital flows to where it is treated best. ESG was never “the best”. Now that there is a value on time, this money will begin to flow to projects with the potential for a positive real return. Investors aren’t in this game to virtue signal and those that are will quickly be outed as fools and separated from their money.

What does that mean for the average investor? It means that those companies with tangible assets, that produce goods that consumers need, and are profitable will see investors flock to them. Those companies that promise growth at the expense of current returns will suffer. These pipe dreams sold to investors at 20x future earnings aren’t going to look so good.

I watched that this morning. Then You Tube recommended the 6/21 "Green Swan Conference" (climate central banker zoom call) in which Powell was a part of with other central bankers. Lagarde spoke first and went in full environmental alarmist mode and the others echoed her propaganda - it all felt weird given their "jobs". When Powell spoke he gave some lip service and basically dismissed it as not his responsibility. Her facial reactions were priceless. Good too see him doubling down today!