‘To the moon’ is a phrase coined in the notorious wallstreetbets subreddit. Typically it means that a certain investment is going to return a hefty profit. In the heydays of GME and AMC taking off, it was widely seen. Looking at the market today, is it turning around and going to the moon? Is it time to buy stocks? My answer is a big NO.

Earlier this week Michael Lebowitz over at RIA wrote about bear market bounces. In this piece, he compared our current situation to that of 2008. Shortly after Bear Sterns was bought by JPM, the market rallied nearly 15% from March 17th until May 19th. Investors thought that the sale had brought about a resolution to the market turmoil. They were quickly proven wrong. After the rally, the market dumped from 1429.75 to a low of 676.0 by March 9th of 2009. At that point in time, the fundamentals had changed and the Federal Reserve was opening the flood gates on the money supply.

Michael’s conclusion was on-point.

“Now is not the time to fight the Fed. Nor is it the time to ignore fundamentals.

Unless the Fed pivots, inflation falls sharply, or financial instability occurs, take advantage of any Bear Stearns-like relief rallies. They provide opportunities to reduce exposure and rebalance your portfolio to a more conservative posture.”

“Do not let a market bounce blind you to the underlying fundamental, fiscal, and monetary conditions. Rising and falling markets are always accompanied by periods of counter-trend movement. In bear markets, relief rallies are opportunities to rebalance and manage risk.”

The Fed continues down the path of higher interest rates and quantitative tightening. This will drain liquidity from the market causing a repricing of assets. It will usher in a recession. All the latest data points to a big slowdown in the economy.

This week saw JOLTs data showing a slowdown in the amount of job openings. We are still trending upwards but we are on shaky ground here.

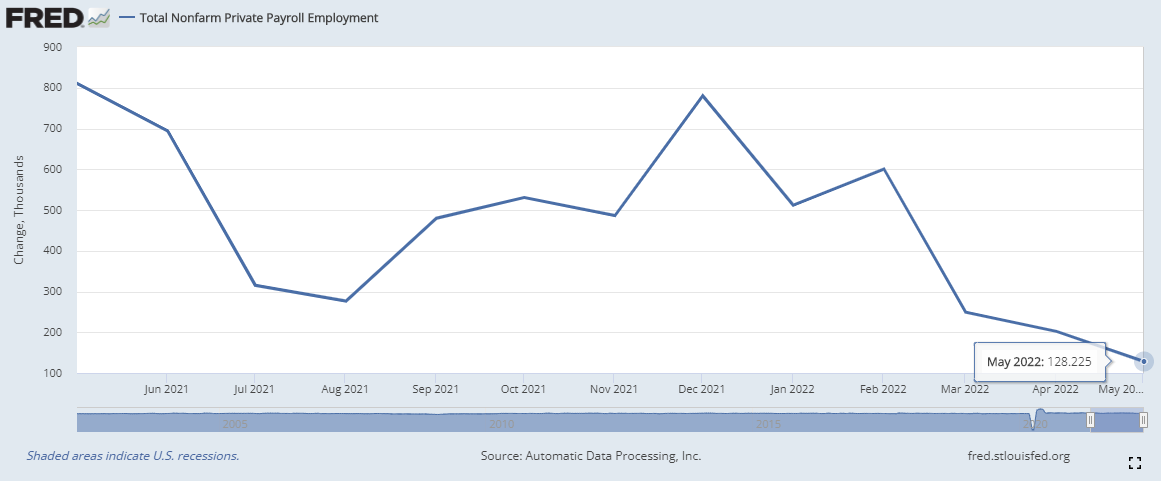

Yesterday’s ADP Employment report showed a drop in the amount of persons hired.

When you couple these two reports together, you are looking at businesses reducing the amount of openings they have while also hiring fewer people. These aren’t bull market characteristics.

This isn’t news to the bigwigs that run the investment banks. JP Morgan’s Jamie Dimon shares the view that the worst is not behind us. In his words you need to “brace yourself” for the upcoming economic “hurricane”. In addition we now have Dawn Fitzpatrick, the chief investment officer for Soros Fund Management, telling the Epoch Times that a “recession is inevitable”.

It is best to use these rallies to raise cash balances and reduce market exposure. Set stop-loss orders and keep your emotions in check. For those who have the wherewithal to short the market, find your targets and pick your positions but remember, the rally in 2008 lasted nearly 2 months. This current rally has lasted 2 weeks. I feel much safer holding oil and oil calls than trying to time the turn lower in the market.

I mentioned on David's post yesterday that this rally still has plenty of room to go up to the 430-440 range on SPY. I'm starting to think it's time to look at puts for unprofitable tech again.