The CPI comes out this week. Unfortunately, I’ll be out for the next three days at a business conference, so I’m going to miss the release day. In lieu of a Wednesday post covering the CPI, I thought I’d give a preview of where I feel the CPI might land.

Here is the 3-year chart for the consumer price index (CPI). Starting around Feb/March of 2021, there has been a strong upward slope. Prior to this inflationary period, the CPI would rise an average of 0.4 points any given month. This equated to an average CPI reading of 1.5%. Since March of 2021, the CPI has risen an average of 1.9 points a month giving us the hot inflation reading for the past year.

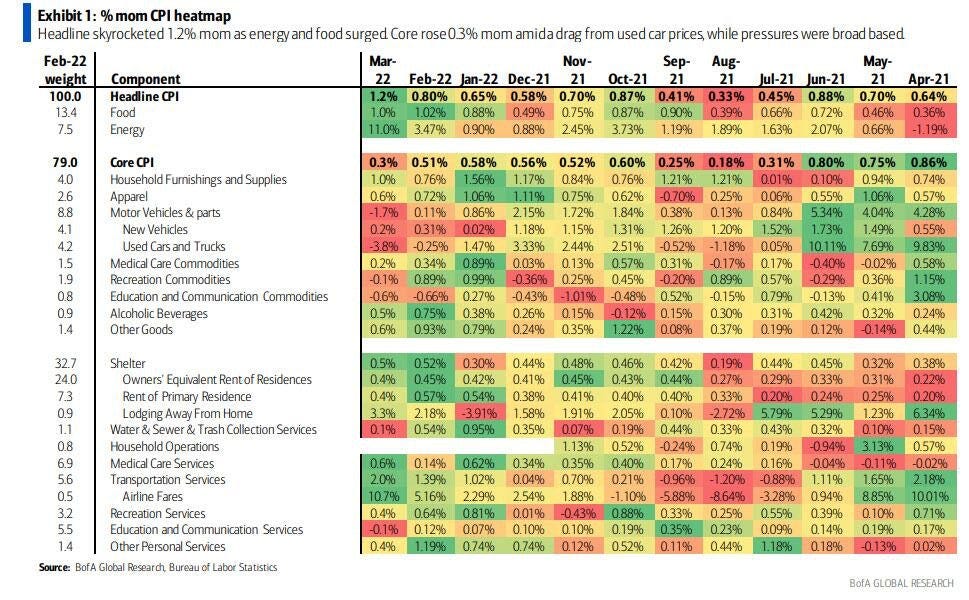

The consensus estimate for Wednesday’s release is 8.1-8.2%. This would be a 0.4-0.5% annual rate decrease from last month’s reading. It would account for a roughly 0.5-1.0 point increase in the CPI (highlighted in green). Here’s the breakdown:

If things hold steady at the 1.9 per month point increase (yellow), the CPI would come in at 8.6%. This matches the prior month’s figure. We’ve begun to hit a ceiling on higher inflation readings. The components that make up the CPI would have to really go bonkers for the CPI to continue to climb like it has and I just don’t see that happening.

None of the components that make up the CPI are going to be able to get hot enough to continue to push this inflation higher. I still believe that ‘shelter’, the heaviest weighted piece of the CPI, is severely suppressed from what the actual should be. Expect shelter to continue to push higher as rental rates continue to adjust. In addition, food costs are just starting to heat up. These two components are the heaviest weighted on the index. Watch for them to buoy the increase on Wednesday.

On the other side, oil peaked in March and has been in a consolidation phase.

This will begin to curb the inflation costs of energy and transportation. I am also seeing a peak in used vehicle prices.

These are 3 of the next 4 heaviest weighted pieces. This will pull down the inflation rate. That is not to say that inflation will go straight back down to 2%. I think what is getting setup here is a 1970’s style of peaks and valleys in the inflation rate.

A characteristic of the earlier inflation era was frequent temporary reversals in inflation, only to be followed by new peaks. I expect this era to play out similarly. Inflation has become very political. It is repeatedly listed as the most important issue according to voters. I also expect the Fed and the Biden administration to take a giant victory lap as soon as inflation looks like it is abating. Once this happens, I believe the Fed will take their foot off the brakes and that this will lead to the next boom of inflation.

Don’t expect this to play out overnight. Look at the above graph again. That is nearly 12 years’ worth of data. We are in the early stages of this game. However, I believe next month will see a sharp decline in the CPI readings. This is because we have hit the statistical peak in year-over-year comparisons. The index rate would need to increase well in excess of the average increase over the last year to sustain increasing inflation. This is perfect timing for the Fed.

The Fed will be able to point to their “aggressive” increase in the Fed Funds Rate (FFR) as proof that they are in control. This will become a false talking point that their policies are working. They are like a shaman who does a sun-dance right before sunrise. This performative political theater will be gobbled up by the mainstream press. This will likely lead to a reversal in the market. The appetite for risk-off assets (commodities, gold, silver, DXY) will dry up and risk-on assets will be bid (non-profit tech, QQQ, bitcoin, ARKK).

A big factor that plays into the inflation increase is consumer spending. The massive covid relief handouts had a direct impact on the inflation rate. Now that consumers have spent those handouts, they are beginning to resort to credit cards to keep up with their lifestyle change.

As budgets get stretched thin, adding additional credit card debt will become prohibitive. This will also begin to cap this wave of the inflation craze.

Last thing, I’ve sold the last of my puts. I have a feeling that Wednesday is going to see an enthusiastic embrace in risk-on assets and I don’t think I’ll be able to manage my puts while I’m at the conference. See you Friday.