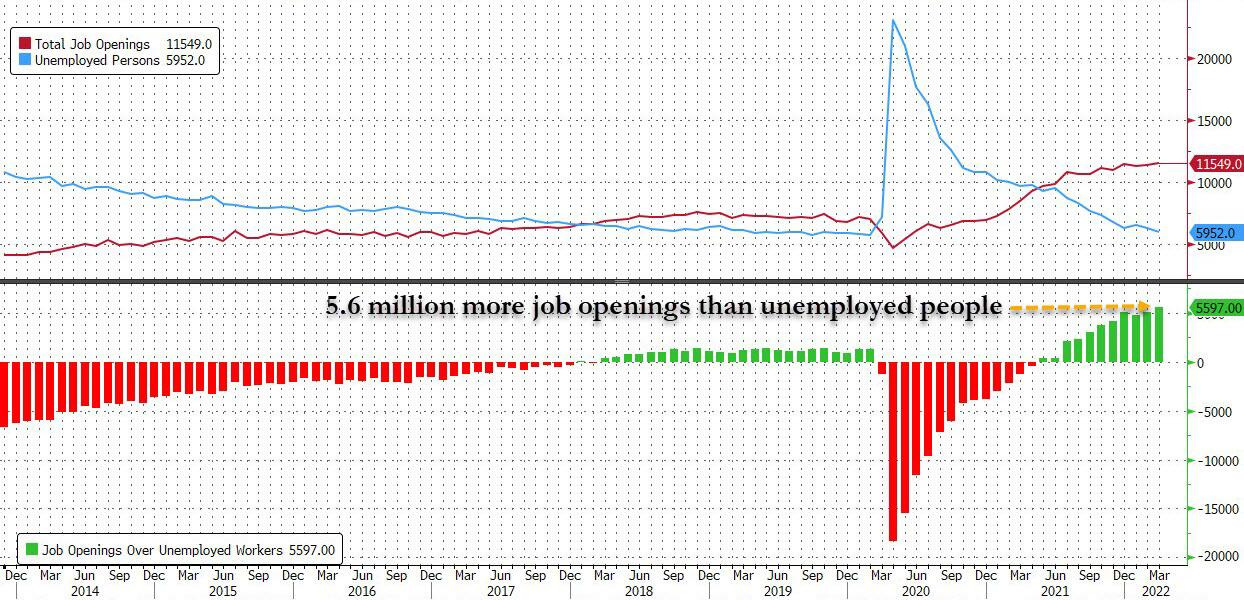

The JOLTS report came out this morning and we continue to have the tightest job market ever. Job openings continue to push up against their all-time high, which was set at the end of last year.

Couple this report with the previous week’s unemployment report and the full picture of the absurdity of the labor situation is exposed for all to see.

This continues to show how businesses are in a serious competition to attract workers. Those businesses that are able to pay higher wages will attract the workers they need to fill these jobs. Those businesses with wire-thin margins will struggle. We see this in the quit rate.

Workers are keeping their prospects open and the quit rate shows it. These workers are not looking to get tied down to a job. They want the flexibility to move to those employers that will pay higher wages and offer the benefits and locations that they desire. This is going to feed the nightmare of Keynesian economists who will begin to fret about the “wage-price” spiral. While they will be able to see this problem coming, they’ll have no idea how it happens or what to do about it. This is another symptom of the Fed’s reckless money printing and we are beginning to see signs of this stress everywhere.

Interest rates are moving higher. They have been climbing at a very accelerated pace. We are still below the recent peak that happened in November of 2018. Interest rates are the basis for loans, bonds, and they can effect the Eurodollar futures curve.

Eurodollar futures can be a pretty nerdy and obscure element of finance. At its most basic component it tracks dollar-denominated deposits at foreign banks. This became a serious problem during the 2007-2008 crisis as banks overseas had very limited access to dollars and when the liquidity in the US became tight, foreign banks suffered. This is eventually what led to the Euro sovereign crisis in 2010. The Eurodollar market is one of the world’s primary international capital markets. It requires a steady supply of depositors putting dollars into foreign banks. When supply problems constrict liquidity, these banks begin to suffer from a lack of deposits. This is what we are beginning to see in the Eurodollar futures curve, a lack of liquidity. This is going to put stress on domestic banks (who lend internationally) and foreign banks (who need access to dollars). This will, in turn, put stress on the Fed.

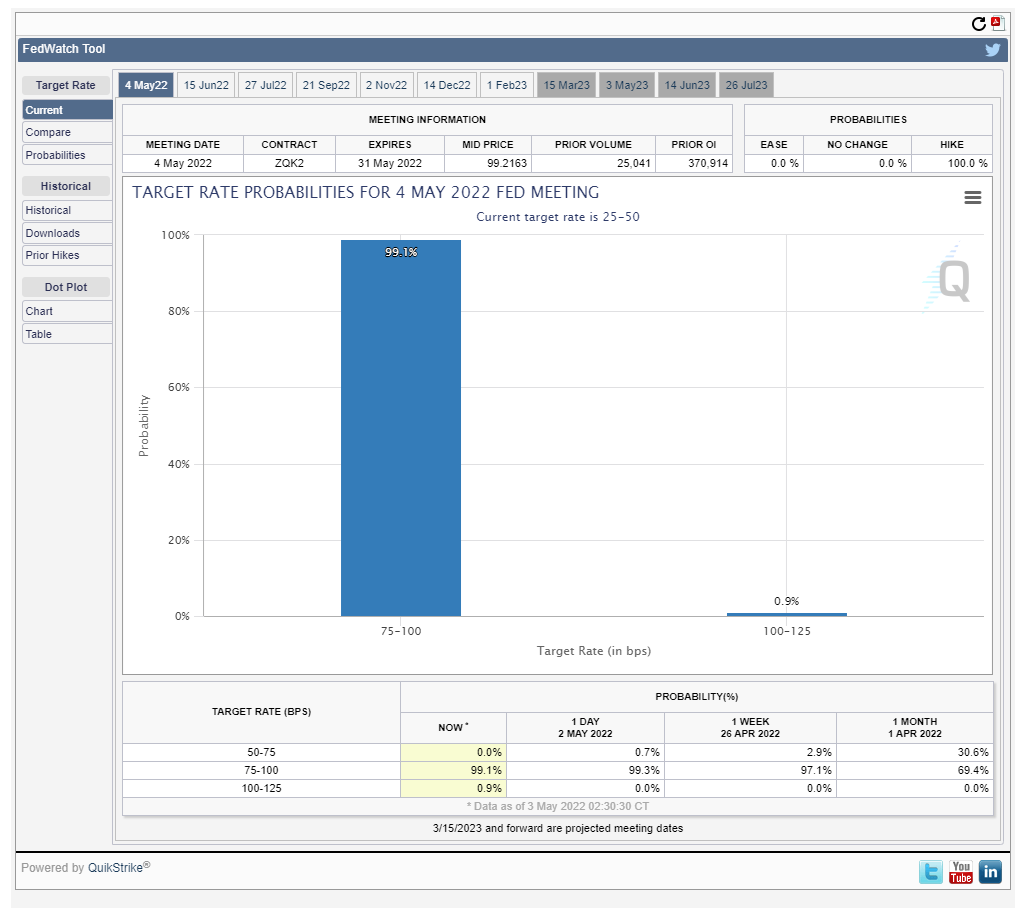

Speaking of the Fed… They wrap up their 2 day FOMC meeting tomorrow with an interest rate announcement.

The CME group’s Fed-Watch tool shows us that traders overwhelmingly believe the Fed will be raising interest rates by 50 basis points. There was a lot of chatter out of the Fed between now and their last meeting about a 75 basis point hike but the market doesn’t believe the Fed has the backbone to pull that off. What is interesting is that the market believes the next two meetings (June and July) will also see 50 basis point increases in the Fed target rate. June’s probability is at 92.7% and July’s 85.3%. This would be a very rapid increase for the Fed.

This is bad news for growth stocks. High interest rates kill the discount cash flow models. This is the model that traders use to discount the future cash flows of a company back to the present. A risk-free rate (typically the 10-year treasury) is used. As it continues to rise, the future cash flows get more heavily discounted, making the stock not look as appealing. A swift raising of the interest rates will destroy the unprofitable tech sector. It thrives on cheap credit and always lowering interest rates. On top of this, we know a recession is coming. Will the Fed be able to raise interest rates high enough to slow inflation’s rapid pace before the recession comes and forces them to cut rates in a feeble attempt to ward off the recession?

The Fed wants inflation to run hot to reduce the real value of excess debt in the economy and then rein in inflation, like the proverbial holding onto the balloon rope as it floats away, when to let go.

At this present moment, talk aside, has the Fed done anything? No.

Does the Fed have any intention to do anything more meaningfull than than a 50bp hike? No.

So, when is a good time to short the S&P 500?