In 1993, John Templeton published his timeless 16 rules for Investment Success (pdf here). In it he stated:

“The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.”

When investors become convinced that “this time is different”, they throw caution to the wind, abandon their discipline and long-held strategies to chase the latest thing. In the late 90s and early 2000s, the latest thing was tech, media, and telecom. In 07-08, it was housing. FOMO (fear of missing out), is real. It is a real psychological trick that our minds play when we appear to be missing out on an opportunity. Right now, as has happened in the past, it seems tech stocks have been hit with a strong case of FOMO and are being chased higher.

The valuations on some of the largest companies in the SPY and QQQ indices are well in excess of normal. Here are a few examples of price-to-earning ratios;

NVIDIA - 178X

TESLA - 51X

NFLX - 39X

GOOGLE - 28X

MSFT - 34X

VISA - 31X

MCD - 31X

AMAZON - 279X

APPLE - 29X

FACEBOOK - 30X

All this reminds me of a quote made by Scott McNealy. At the time Scott was the CEO of Sun Microsystems. It was one of the darlings of the 2000s TMT bubble.

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Comparing Sun Microsystems to NVDA, NVDA is currently trading at 28.5 times annual revenue. Here’s the rest of the bunch from above:

NVDA - 28.5x

TSLA - 6.7x

NFLX - 5.0x

GOOG - 5.5x

MSFT - 11.3x

V - 14.9x

MCD - 8.9x

AMZN - 2.3x

AAPL - 7.0X

META - 5.4X

Compare this to companies in the energy or mining sector:

XOM - P/E = 7.2x, 1.1x revenues

OXY - P/E = 6.8x, 1.5x revenues

COP - P/E = 8.3x, 1.6x revenues

EC - P/E = 2.7x, 0.5x revenues

VALE - P/E = 4.2x, 1.4x revenues

RIO - P/E = 8.0x, 1.8x revenues

You are welcome to accuse me of cherry picking the data or telling me I don’t know how to properly evaluate the growth that these companies could achieve. I would entertain that argument but I would also point out that of the 10 companies that I selected, 8 of them are the top 10 largest publicly traded companies. So please tell me how these companies going to be able to return value to shareholders and grow their businesses at these current valuations? Is it different this time?

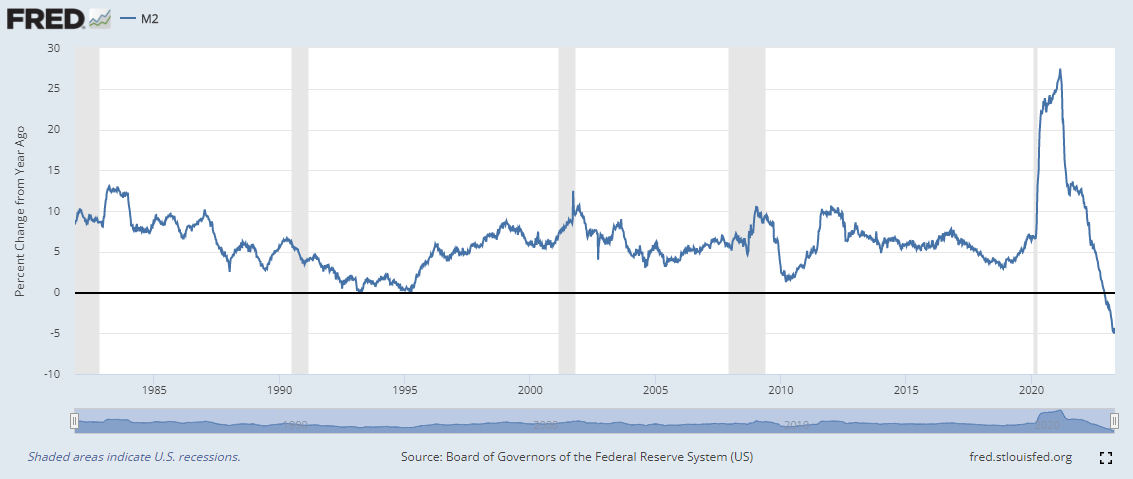

I bring all this up because today saw the release of the H.6 Money Stock Measures report from the Fed. It continues to trend much of the same way that it has trended since April of 2022 when the money spigot got turned off. Here is a look at the year-over-year comparison.

We are looking at a severe contraction of the money supply when analyzed on a 13-week annualized basis.

At the same time, we are seeing margin debt use by traders stay flat:

And that money that is supposedly waiting on the sidelines is fleeing for greener pastures:

Margin debt and free credit balance figures are shown in the millions. This means $33.26 billion has left the free credit balance category since the start of the year.

Meanwhile, we are staring at one of the worse yield curve inversions ever…

So, could this time be different? Could the money supply contract, margin debt stay under-utilized, the yield curve stay inverted, the country avoid a recession, and the stock market avoid a crash?

Here’s a secret, this time is never different but it is always different. It ties in with Mark Twain’s quote about how history doesn’t repeat but that it rhymes. I think there is a way out of this mess. I think it starts with the Fed maintaining restrictive interest rate policy but we also need to see the fiscal side of the equation get their house in order. That means this debt ceiling fight is extremely important. Congress needs to cut spending in a bad way. The Fed can’t win this fight alone. It needs Congress to figure out how to cut fiscal spending and get onto a more sustainable path forward. That happens in this debt ceiling fight. If the Fed were to go it alone, we are gong to see much higher interest rates which will become extremely restrictive and cause an economic contraction and stock market correction. If Congress were to get spending under control, we may still see a correction in the stock market but I believe interest rates won’t need to go as high and a correction at that point would be a healthy opportunity to put funds to work.

Finally I’ll leave you with a little wisdom from Jesse Livermore, who said;

“Another lesson I learned early is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

So do you buy NVDA here? Should we ask those people who invested in Sun Microsystems if it worked out for them?

Here's hoping the AI mania gives us a nice blow off top to short. Tech has gone nuts. This is not a healthy bull market for sure.