The Producer Price Index (PPI) came out today and it was down 70 basis points over the past month but was higher than expectations.

The PPI tracks the average changes in prices for domestic producers to make their goods. The PPI peaked in March of 2022 at 11.7%. It has dropped off suddenly since June 2022’s reading of 11.2%.

I believe that the Fed will see this as confirmation of good news on combating inflation. Not enough to pause rate hikes but enough to slow their pace. The next FOMC meeting is Wednesday where Powell and Co are expected to raise interest rates by 50 basis points. I believe this report dovetails nicely into Powell’s previous public speaking events. The CPI comes out the Tuesday before the meeting. That will be the report to really key on to see how the Fed will react.

On the opposite side of the inflation coin we have the fiscal side of the equation where shenanigans are constantly afoot.

The administration has spent billions in Ukraine. They’ve attempted to spend billions on student loan debt forgiveness. Now they are spending billions on pension fund bailouts. This is inflationary. They are spending money they don’t have in an inflationary environment.

On the one hand, we have the Fed combating inflation by raising interest rates and choking-out demand. On the other hand, we have an administration punch-drunk spending like inflation doesn’t matter. I’ve got bad news for the administration, the Fed will win this fight if they so choose to. You may control the purse strings (spending tax dollars) but the Fed determines what they are actually worth (interest rates). Continue to go toe-to-toe with the Fed and you will end up with more than one black eye, just ask the ECB.

I have an update to the RIG piece earlier this week. Transocean was awarded two drilling contracts for it’s Deepwater Corcovado and Deepwater Orion. Corcovado was under contract until July 2023 with a day-rate at $198k. Orion was idle. Corcovado was awarded a $583M 4-year contract (estimated $400k day-rate), and Orion was awarded a $456M 3-year contract (estimated $415k day-rate). This will add another $1B to Transocean’s backlog (work contracted for but not yet completed). In addition, these are impressive day-rates. It bumps up their rig utilization rate and their day-rate, moving them quickly into more profitable territory.

Finally, I wanted to spend some time talking about a new tool I’m working on developing. If you haven’t figured it out yet, I’m obsessed with data.

Some of my favorite data is the money supply report, insider purchases and sales, the margin debt statistics but now I’m working on another. Banks and hedge funds are forced to disclose their purchases and sales through a weekly Commitment of Traders (COT) report. It is posted by the CFTC and it looks like a hot mess. Here is a link to the latest reports. I’ve been attempting to aggregate the data into a digestible format in the hopes that some advantage could be found. Here is my first example, oil:

I’m using a 32-week look-back period. I’m specifically looking at non-commercial data, which means banks and hedge funds. Commercials would be the producers and users. What I see with the non-commercials with regards to oil is that they have lighten up their positioning significantly since April. They have fewer long contracts but they also have fewer shorts.

Some things that jumped out to me;

Oil peaked on June 7th. This coincided with the long contract peak.

Oil continues to fall in lock-step with the reduction in non-commercial long positions.

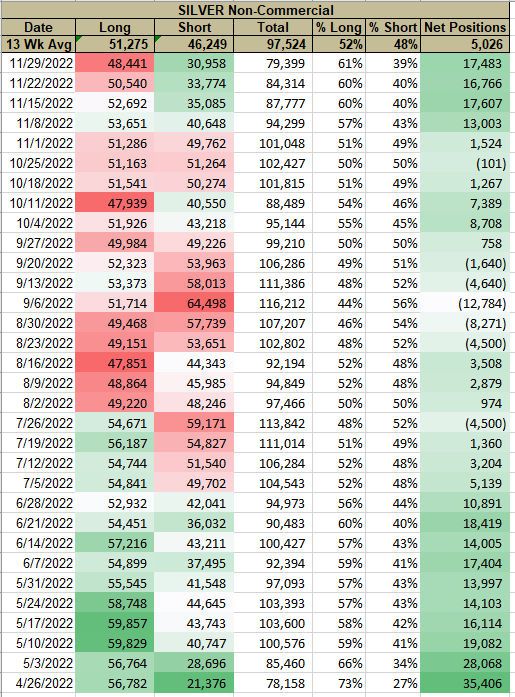

I’ve also taken a look at silver, which has had a terrific past few weeks.

While silver hasn’t seen an increase in long positions by non-commercials, it has seen a large reduction in the amount of shorts. The peak short position happened on September 6th which closely matches the recent bottom for silver (8/31 at $17.55).

At the least I think this certainly warrants further examination. In addition to oil and silver, I’ve built a sheet to track natural gas, gasoline, copper, gold, S&P500, Nasdaq, 2-year treasury, and the 10-year treasury.

There is much more data at the CFTC but I need to see that this works before I go further.

After the market crashes, mouthpiece economists will blame the raise in interest rates, not the insane monetary policy of the last 3 years.