The unemployment rate came out today and there is panic on Wall Street.

The unemployment rate came out at 4.3% for the month of July. This exceeded expectations of 4.1%. It also triggered the “Sahm rule”. This “rule” is named after Claudia Sahm who was formerly employed by the Federal Reserve. Understand that this “rule” is an approximation and is actually designed for use by the Treasury, not the Fed. According to Claudia, the purpose of the rule was “to send out stimulus checks automatically. The idea was to act fast to make the recession less severe and help families.” Which means the rule is designed to trigger a further distortion in the normalization process of the economy. It also sounds like the kind of trashy economic advice the government loves to act on.

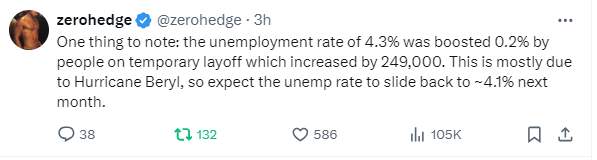

In reality, I think zerohedge leaked the real reason unemployment surprised to the upside and why the panic is overblown.

If true, today should be a great day to buy.

Other employment indicators show that the supply and demand for labor is coming back into a better balance.

There is still 1.2 job openings per unemployed worker which is comparable to the era from August of 2018 through February of 2020. Also, the percentage change in hourly earnings is starting to normalize.

In addition, the economy is continuing to add workers at a rate of 1.6% year-over-year.

There are two charts that came out this morning that do have me concerned.

The above chart from the Bureau of Labor Statistics details workers who are employed and usually work full time. It had been a great indicator of recession when the percentage change went negative. Of course, we cannot have a recession without a republican president.

Another indicator that had a decent track record was durable goods orders.

Which has slipped to a deeply negative 10.4% year-over-year.

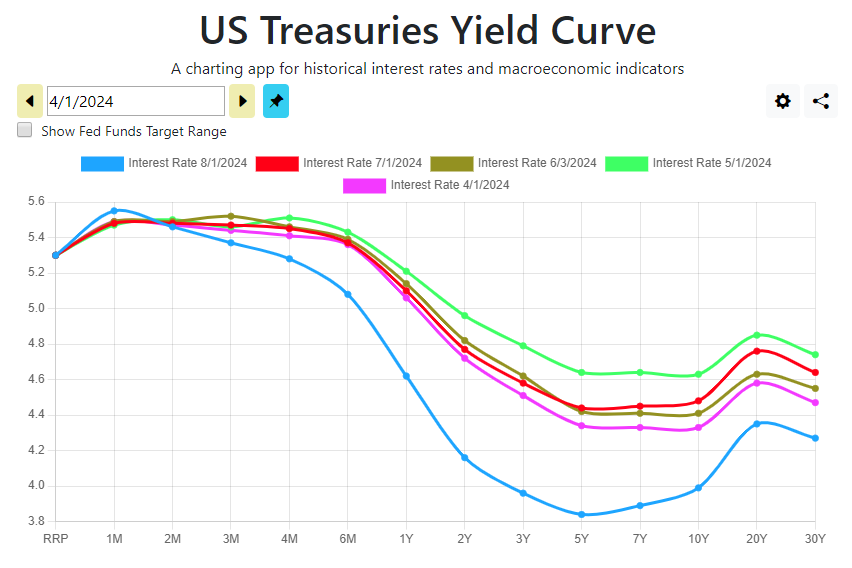

Finally, there is the yield curve.

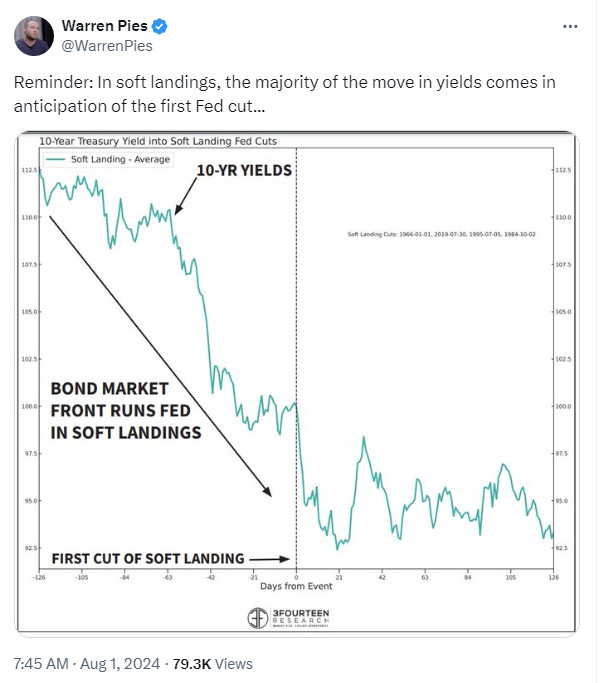

The month of July saw Treasury yields go down. This means there was a lot of money chasing US Treasuries especially the notes (2yr-7yr). Warren Pies had a good piece on this posted on X.

It looks like traders are front-running the Fed’s expected rate cut. This means they are rotating out of stocks and into bonds. Remember, don’t lose your mind here. This looks like an opportunity to buy.

Is it a buying opportunity if money supply growth remains tepid?