"This part of the crisis is over"

Proving even the smartest guys arent immune to bouts of stupidity

The above quote comes from Jamie Dimon shortly after his bank, JPMorgan, bought First Republic Bank in a sweetheart of a deal. According to USA Today,

Dimon said there’s a chance “another smaller” bank fails, but “this pretty much resolves them all.”

“I think the banking system is very stable,” he said. While there are still concerns over rising interest rates and the potential for a recession, “everyone should just take a deep breath.”

Open mouth insert foot.

Today saw renewed alarm in the regional banking sector.

PacWest (PACW) and Western Alliance (WAL) plunged Tuesday as investors remain convinced the worst is not yet over for troubled regional banks.

Their drops of more than 20% in morning trading come one day after JPMorgan Chase (JPM) purchased the bulk of First Republic (FRC), in a deal that was designed to restore stability to the banking system after two months of turmoil.

Both lenders, like First Republic, lost a sizable amount of deposits during the first quarter as customers sought the perceived safety of larger banks or higher yields being offered by money market funds. PacWest lost 17% of its deposits and Western Alliance lost 11%, while First Republic lost 41%.

I believe much of the panic in the regional banking sector is overdone. Yes the Fed's rapid increase in rates has caused issues for poorly managed smaller banks. These banks did a poor job managing risk and hedging interest rate risk in their bond portfolios leading to many having large allocations of “hold-to-maturity” (HTM) bonds on their balance sheets. In addition, their loan books are also filled with underwater “hold-for-investment” (HFI) bond portfolios. These two factors severely limit the bank’s ability to be profitable.

If you bought a house prior to 2021 and your interest rate is under 4.25%, you have no incentive to refinance or to pay off your loan early. Right now, Fidelity's money market account is paying 4.5%. The interest that you earn in a money market would be greater than the interest you would owe on your loan. These higher rates have encouraged savers to move their money into t-bills, CDs, and money market accounts. This has caused double pain for the regional banks. They are losing deposits to money market accounts and seeing their bond portfolio lose value. You should be able to spot which banks are concerned about their deposits as they will begin offering higher CD rates. They may also begin offering higher savings interest rates in order to attract much needed capital.

Something that I am keeping my eyes on are opportunities in the regional banking sector. When I see bankruptcies, consolidation, and investors fleeing, I want to begin understanding that sector better. In time, there will be deals to be found here. In my mind, PACW and WAL are not FRC. This selloff in all things regional banking is a “baby and the bathwater” scenario. I expect this to continue to play out for the next two quarters. The two keys to finding value in distressed businesses is understanding the business’s ability to generate cash flow, buying when you have a margin of safety, and not buying in too early.

There is also much to be concerned about regarding the debt ceiling debate. The good news is that McCarthy was able to get his bill passed. It has now been sent on to the Senate. The Senate has also put forth a plan for a “clean” debt ceiling raise which means the bill would raise the debt ceiling without any spending cuts. McCarthy announced back on the 27th that “No clean debt ceiling is going to pass the House”. But now pressure is being applied to the situation. We have Chuck Schumer’s “clean” debt ceiling bill and now we have House Minority leader Hakeem Jeffries filing a discharge petition which would force a vote on a clean debt ceiling increase in the House. Biden is also attempting pressure of his own on McCarthy, inviting him to the White House for a struggle session. That meeting will take place on May 9th. In addition, Treasury Secretary Janet Yellen announced that the US Treasury could run out of funds as early as June 1.

This lines up with Goldman’s take that the Treasury would run out of funds in early June, though my estimate was mid-to-late July.

In the above linked article I began to hash out what the debate would look like and which players would be involved. At the time I thought that Senate Majority Leader Chuck Schumer would need to be in the game but now I am having second thoughts. The real power in the Senate is still held by Joe Manchin and to a lesser degree Kyrsten Sinema. These two could easily sway moderate Democrats to vote for a debt limit increase that would be tied to certain spending cuts.

To me, the Yellen announcement of early June seems like a bluff. Bluffing is always dangerous for two reasons. The first is that you risk losing capital. In Yellen’s case, that would be political capital. The second is your get a “boy who cried wolf” syndrome and people stop believing you. If she isn’t bluffing and intends on stiffing US bondholders, she better wake up. In 2017 this woman said “not another financial crisis in out lifetimes” is about to cause a financial crisis.

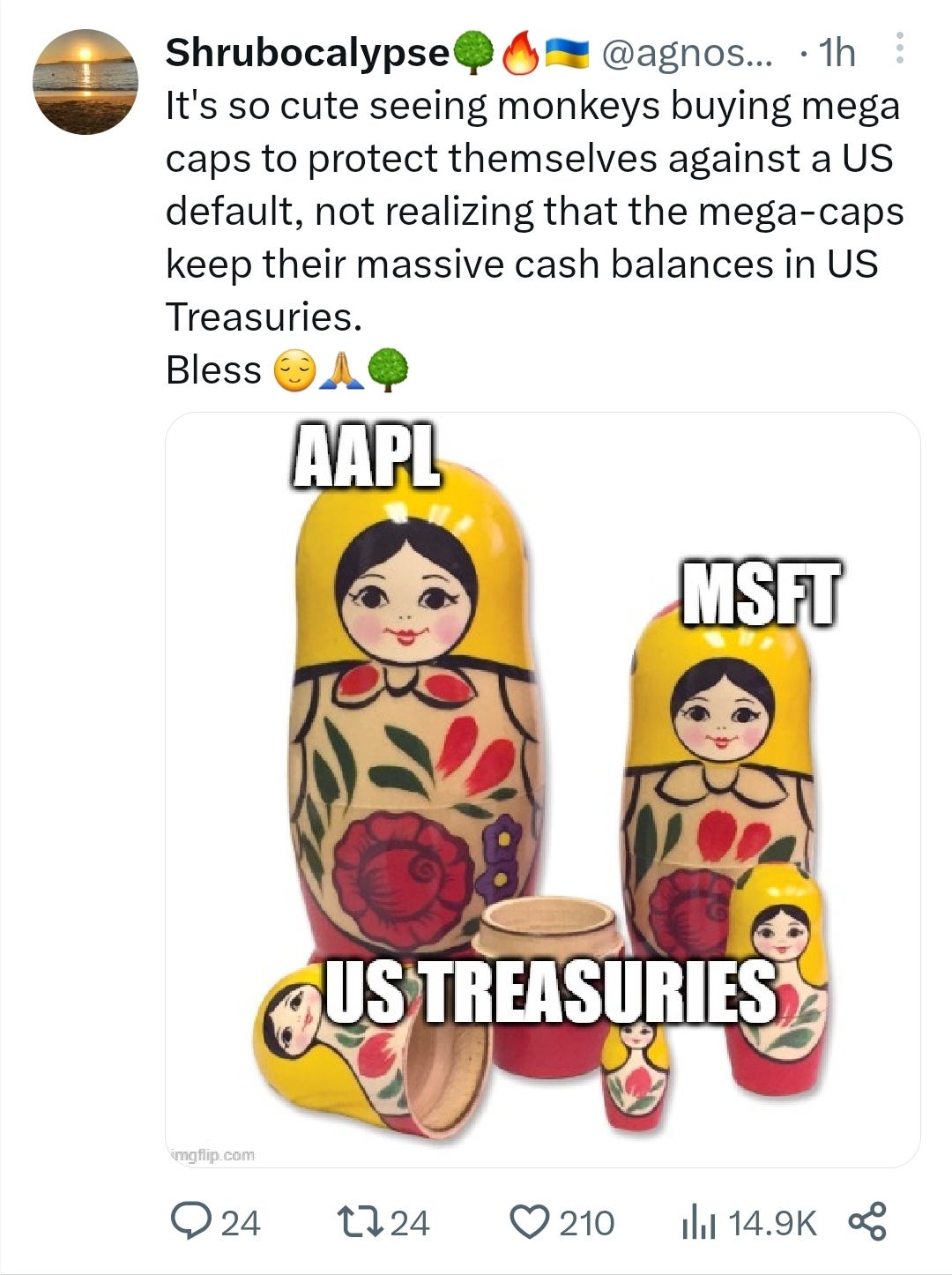

Everybody holds US Treasuries. By everybody, I mean, everybody. Mega-cap companies like AAPL and MSFT, all banks, hedge funds, large investors and investment banks, as well as foreign countries. To stiff these people would be the height of hubris. This is why I am not putting it outside the realm of possibility. The current administration has not lacked hubris since taking office.

"Both lenders, like First Republic, lost a sizable amount of deposits during the first quarter as customers sought the perceived safety of larger banks or higher yields being offered by money market funds."

This circles back to something I recently shared in the latest money supply report. Money market funds are making a killing at the reverse repo trough. And that has been yet another kick in the junk for the smaller banks. Everything the Fed does has consequences. They just make sure the consequences don't land on their buddies. Buddies like Jamie Dimon, who gets to take whatever he wants.