Back on the 13th, I had laid out why I was voting no on the Turquoise Hill (TRQ) deal with Rio Tinto (RIO). My thinking was that RIO was getting a steal from shareholders by offering $31/share while the book value was around $45/share. Now other shareholders have picked up on this and the TRQ management is beginning to scramble.

On the 14th, SailingStone Capital Partners, which is the 5th largest shareholder in TRQ, stated that they were opposed to the deal.

“Rio's bid undervalues the Canadian miner, SailingStone said in a statement, adding that the offer attempts to take advantage of the "material governance failures" created by independent directors of both companies over the last decade.”

In addition to SailingStone, Pentwater also came out against the deal. Pentwater is the second largest shareholder next to Rio (who owns 50% of TRQ).

Then a proxy firm named Institutional Shareholder Services (ISS) urged shareholders to oppose the deal.

“While the offer provides an escape from the immediate downside, certainty of value today comes at a cost that is too high to be tolerated,” ISS said, adding that the severity of the downside risk is outweighed by the magnitude of the discount to net asset value implied by the offer. “As such, support for this offer is not warranted.”

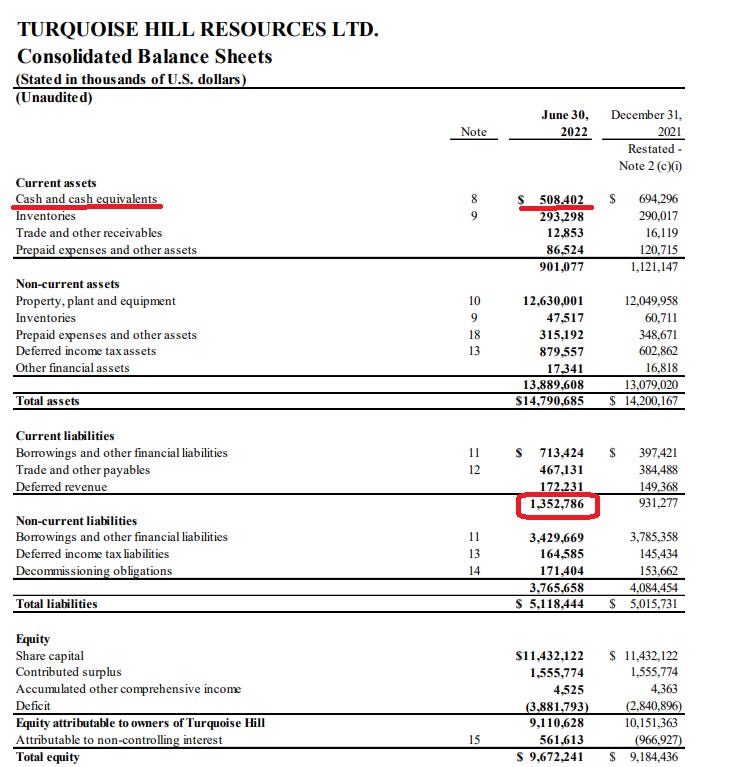

The “escape from the immediate downside” that ISS is talking about here is TRQ’s debt load. TRQ is facing serious funding problems because of poor management decisions.

ISS coming out against the deal is pretty wild. It runs counter to Glass Lewis, the proxy firm chosen to advise shareholders on the deal. It makes it seem that TRQ and RIO purposely sought out a proxy firm that would endorse their deal.

Turquoise Hill then announced an extension of the proxy deadline for shareholders to vote on the deal. Now they are announcing a postponement of the special meeting to November 8th.

This deal really boils down to Oyu Tolgoi which is a mining operation in Mongolia. Turquoise Hill put significant time and effort into reaching an agreement with the government of Mongolia to solidify the deal. They own 66% of the mine and the Mongolian government owns 34%. The open pit portion of the mine began operations in 2011 but it wasn’t until January of this year that the underground operations were approved. Underground production is likely to begin in the first part of 2023. This is where the real value of the mine is going to be captured. It is estimated that it will swiftly become the 4th largest copper mine in the world.

In addition to the size of the mine, its location is incredibly important. China is a large consumer of copper. With the development of this mine, Mongolia will be able to significantly increase their trade with China, attracting much more investment into the country.

Now I see this deal going one of three ways:

First, RIO could increase their price for the merger. We know that RIO really wants full access to Oyu Tolgoi, so how much are they willing to spend for it? Might they negotiate with SailingStone and Pentwater on a more amicable deal? I think an offer around $40 would get everyone’s attention.

Second, RIO could cancel the deal and let TRQ address their debt struggles. Keep in mind that RIO is a 50% shareholder. Would they welcome TRQ declaring bankruptcy? They might get a chance to pick up Oyu Tolgoi in the process. Would TRQ actually go bankrupt? Doubtful since they have quite a few assets to sell first. In addition, they have room to sell more stock to cover their cash shortfall. However, selling assets would reduce their ability to generate income causing somewhat of a downward spiral of the company and issuing more shares would dilute the value of the current shares.

Finally and this is an offshoot of #2, RIO could cancel the deal and begin selling their shares of TRQ. Such a large shareholder dumping stock would cause significant price disruption. My guess is that many shareholders would head for the exits. The share price could quickly hit $10-13. At that point, RIO could again attempt to offer $31/share or less at which point, many shareholders would concede.

I highly doubt that #3 would take place. RIO knows that the Oyu mine is going to be a big money maker. They would not want to allow even a possibility of that slipping through their fingers. Selling TRQ stock could allow someone like FCX to step in and out-bid them. Holding 50% prevents that from happening.

So then what are the odds of the other two? I would put it around 50/50. Looking at TRQ’s most recent financial records, I would guess that they would need to sell around 35M shares to afford their currently liabilities minus their cash on hand and 55M if you don’t subtract the cash. This is a pretty significant amount when compared to their share float of 96.47M. It won’t be easily absorbed by the market since their daily average volume is 1.63M shares.

So what is a shareholder to do? My plan is to sit tight. You may want to contact a financial professional for professional advice. For me, TRQ is less than 1% of my account. While my hope is that RIO will come to their senses and pull a Vader, even if they don’t, at 1% I’m not losing sleep over it.