Investors have awoken to what the OPEC+ cuts really mean. There is now a floor under the oil price and it has absolutely sky-rocketed today. I find it very hard to believe that the Biden administration will be able to refill the SPR with sub-$80/bbl oil anytime soon. Meanwhile stocks are struggling. This feels like a repeat of the first quarter of the year.

Today the BLS released the employment situation. This included the unemployment rate which was the lowest it has been since 1969.

Stocks cratered on this news because it paves the way for the Fed to go ahead with another 75 basis point increase. Right now the CME Fed Watch Tool shows over an 80% chance of that to happen.

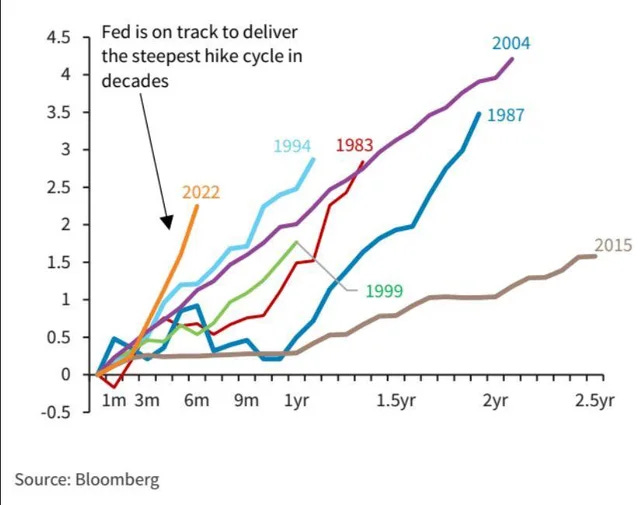

The Fed is already on pace to have the steepest hike cycle in decades.

Yet they are still behind inflation.

Looking at the longer term comparison, the Fed is way behind the ball here and I think they know it.

The Fed’s Chris Waller spoke at an event yesterday in Kentucky. He gave a great speech about the state of the economy, inflation, and the housing market. His speech reinforced the fact that I have been hammering on, the Fed has a singular mandate at this time.

“As a result, I don't expect tomorrow's jobs report to alter my view that we should be focused 100 percent on reducing inflation”

He covers the most recent inflation data and sums it up with,

“These numbers indicate that inflation is far from the FOMC's goal and not likely to fall quickly.

This is not the inflation outcome I am looking for to support a slower pace of rate hikes or a lower terminal policy rate than projected in the September 2022 SEP. And, though there are additional data to come, in my view, we haven't yet made meaningful progress on inflation and until that progress is both meaningful and persistent, I support continued rate increases, along with ongoing reductions in the Fed's balance sheet, to help restrain aggregate demand. As far as achieving our dual mandate, this is a one-sided battle. We currently do not face a tradeoff between our employment objective and our inflation objective, so monetary policy can and must be used aggressively to bring down inflation.”

Bold is mine.

The big drop in gasoline prices heavily affected the last CPI report. Now with oil on the rise, I don’t expect a repeat anytime soon. It will be very challenging for the Fed to reduce energy costs. They are unable to print oil. That ball is really in the fiscal’s (Congress and the Presidents) court. Unfortunately, we know they are not going to do anything in the American public’s best interest in this regard.

Venezuelan oil is not a viable solution. Their oil is of very poor quality, very heavy, and full of sulfur. It has to be heavily blended with higher quality oil (like US shale oil), to become a good refinable product. I have already outlined what a response would look like for lower oil prices.

“There are a few options that could alleviate this. First, the US could open up more drilling permits for oil E&P companies. They could extend special financing programs to refiners to expand capacity. They could also suspend RIN compliance.”

When these things start to happen, the end of high oil will be near. We are a long, long way away from that moment.

Back to Waller,

“So, as of today, I believe the stance of monetary policy is slightly restrictive, and we are starting to see some adjustment to excess demand in interest-sensitive sectors like housing. But more needs to be done to bring inflation down meaningfully and persistently. I anticipate additional rate hikes into early next year, and I will be watching the data carefully to decide the appropriate pace of tightening as we continue to move into more restrictive territory.

I've read some speculation recently that financial stability concerns could possibly lead the FOMC to slow rate increases or halt them earlier than expected. Let me be clear that this is not something I'm considering or believe to be a very likely development.

The focus of monetary policy needs to be fighting inflation.”

Those dreaming of a Fed pivot need to wake up. Unless something seriously breaks, there will be no pivot. Even a pause in policy looks unlikely until well into the 1Q of ‘23.