Unemployment, Savings Rates, and the PCE

The employment situation report dropped today and in it we got a surprise to the upside on the non-farm payrolls.

“The US economy unexpectedly added 263K jobs in November of 2022, beating market forecasts of 200K, and following an upwardly revised 284K in October. It is the lowest job gain since April last year, as the labour market is normalizing after the pandemic shock. Still, it continues to signal a healthy and tight market, above the pre-pandemic average of 150K-200K jobs created per month. Notable job gains occurred in leisure and hospitality (88K), including a gain of 62K in food services and drinking places; health care (45K); and government (42K), mostly in local government (32K).”

We also continue to see the tight labor market play out in the unemployment rate which sits near past cycle lows at 3.7%.

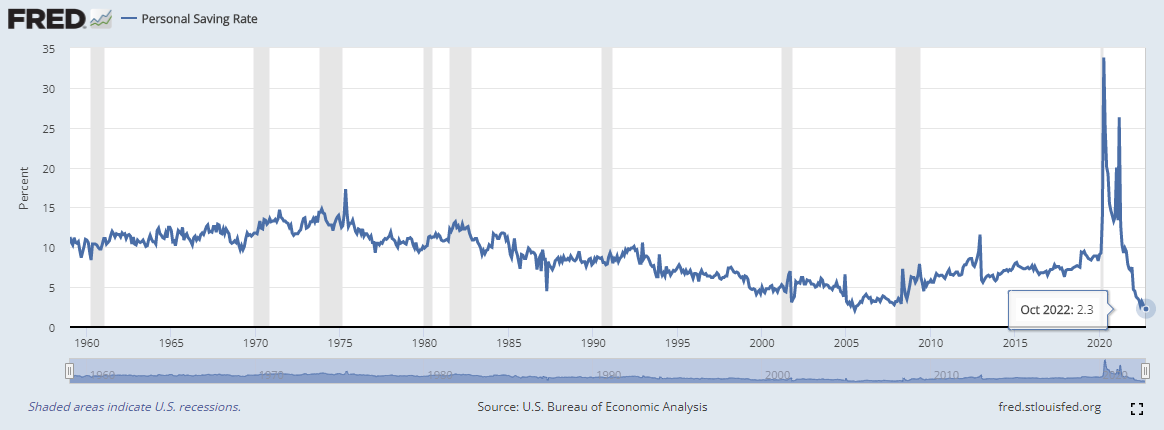

We are also witnessing one of the lowest savings rates of all-time.

The only time the savings rate has been lower in the 63 years that this data has been published was in July of 2005 (2.1%). At the same time we are seeing heavy credit card usage.

These do not look like signs of a healthy consumer. This kind of spending will not be sustainable and when it stops, company profits will falter. In the meantime, the news media is going to go to great lengths to put out data that looks appealing. Both Forbes and Business Insider have highlighted the “record” numbers over the last week in sales. None of these record sales are adjusted for inflation. To be fair, the stock market isn’t adjusted for inflation either. Higher sales will lead to earnings growth which typically leads to stock market gains. The problem that both businesses and consumers are facing though is inflation.

The Fed’s preferred measures of inflation came in at 5.0% for the ‘core’ PCE…

and 4.68% for the trimmed mean PCE.

These record sales numbers aren’t happening in a vacuum. While inflation is eating up the purchasing power of consumers, wage rate increases continue to stay strong.

At 5.1%, hourly earnings have not been keeping up with inflation but they have done enough to stave off an immediate recession.

The market continues to play dumb regarding Powell’s comments yesterday. Even today’s immediate reaction regarding the employment data was retraced by the end of the day. It reminds me of a famous quote.

““In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.”

Rudiger Dornbusch

The idea that moving from 75 basis point increases to 50 point increases is a pivot seems beyond bizarre. In time, this kind of speculative behavior will catch up with the broader market.