In the short run, the market is a voting machine. But in the long run, it is a weighing machine. -Ben Graham

This was an important week. We closed the month and I expect September to be a big month for positioning in the stock market. First the data:

My favorite inflation indicator continues to show inflation has been stopped in it’s tracks.

An interesting bit is that when you look at the index (found here), there is a double top forming.

“A double top is an extremely bearish technical reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs. It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs.”

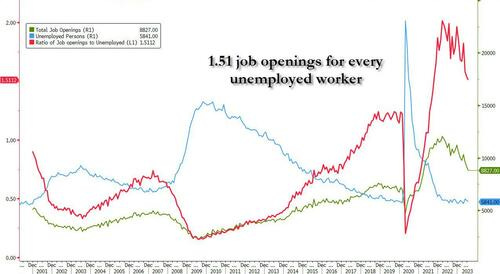

This week also saw the release of employment data. Early in the week there was a lot of doom and gloom surrounding the report. Zerohedge ran with the title “Labor Market Implodes”. They then went on to highlight the downward revisions that have been occurring in these labor reports. Bears are gonna bear. Personally, I don’t see a lot of imploding. My eyes are still fixated on the amount of openings for every unemployed worker.

Wake me up when this figure starts to hit 1.2-1.25. Then I might get excited about a real contraction in the labor market. The latest labor figure is the unemployment rate, which was released today.

It ticked up to 3.8% from 3.5%. This surprised forecasters who thought it would hold steady at 3.5%.

My belief continues to be that we are in a rolling-recession/rolling-recovery environment. Some sectors are doing fine while others are in a recessionary level. Then the script flips. There has undoubtedly been a mis-allocation of capital during the low interest rate environment. This is getting squeezed out of the market. I believe the bigger mis-allocation happened overseas in the euro-dollar market. These are dollar loans that take place outside of the US. By raising interest rates and promising “higher for longer”, the Fed is crushing this capital that has been poorly used and is bringing it back home. Capital is always going to where it is best treated and there is no place like home.

Capital goes where it is welcome and stays where it is well treated.

-Walter Wriston

I greatly enjoyed the latest MacroVoices podcast with guest Brent Johnson. Below are some links:

https://apolloacademy.com/inflation-is-still-a-problem/