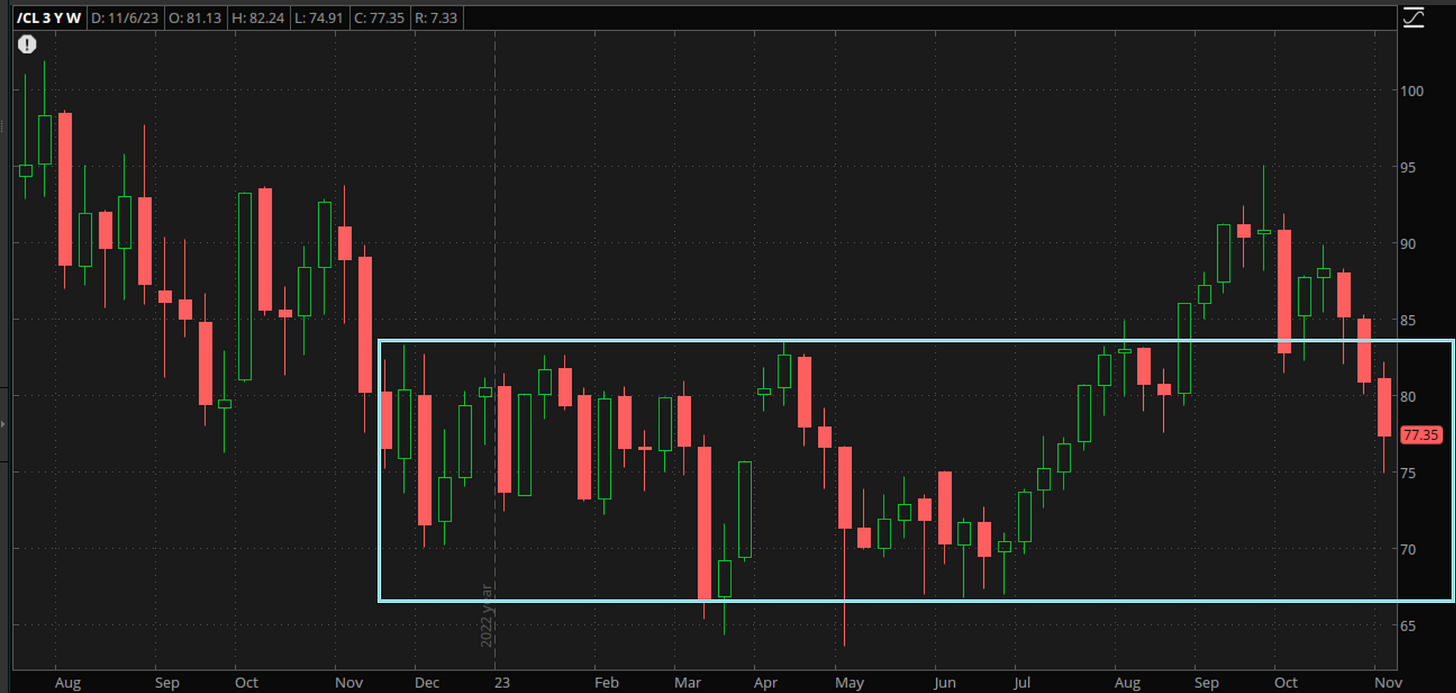

It seems while I was away doing my 9-5, almost all of my stops hit. All my things got sold. The crushing of the oil price will do that. Seasonally speaking, oil is weak this time of the year.

We’ve fallen back into the trend that started in Nov of last year but I don’t think we are going to stay there long.

It should go without saying that oil is highly political and the politics of the middle-east have really been heating up. On Armistice Day, we had an Arab leader summit hosted by Saudi Arabia’s Prince Mohammed bin Salman. Those in attendance included Iranian President Ebrahim Raisi, Turkish President Tayyip Erdogan, Qatar's Emir Sheikh Tamim bin Hamad Al Thani and Syrian President Bashar al-Assad.

Prince Mohammed affirmed the kingdom's "condemnation and categorical rejection of this barbaric war against our brothers in Palestine".

"We are facing a humanitarian catastrophe that proves the failure of the Security Council and the international community to put an end to the flagrant Israeli violations of international laws," he said in an address to the summit.

Palestinian President Mahmoud Abbas said Palestinians were facing a "genocidal war" and urged the United States to end Israeli "aggression".

Raisi hailed the Palestinian Islamist militant group Hamas for fighting against Israel and urged Islamic countries to impose oil and goods sanctions on Israel.

Iran has already floated the idea of using an oil embargo.

Libya has done the same.

How long until that oil embargo is extended to countries further west than Israel? What would that do to the the crude oil futures price?

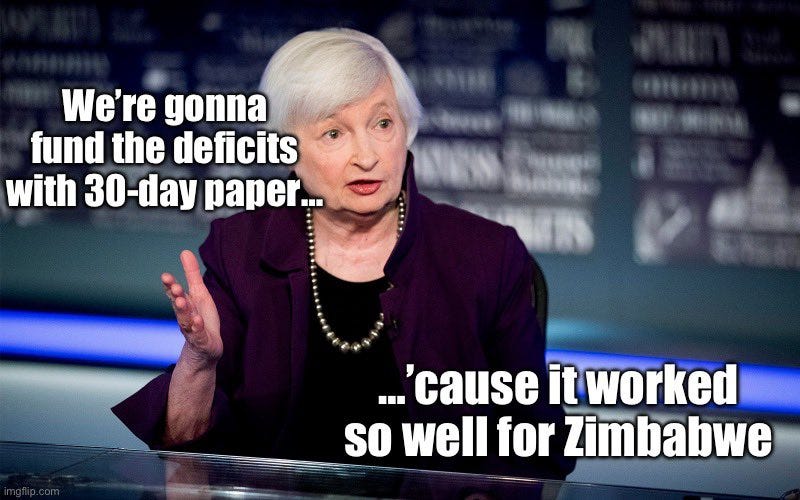

The US Treasury market has had quite a rally recently.

This is highly driven by the Treasury Secretary’s policy of funding the government on the shortest term paper she can.

On Friday, Moody’s downgraded its outlook on US credit ratings from stable to negative. This should be a sign that the current US Treasury Secretary is not doing a good job and needs to be replaced immediately.

Billionaire investor Stan Druckenmiller feels the same way I do about the situation.

Druck also nails the consequences. The tide in the bond market isn’t set to really go out until 2026 through the 2030s when 5, 7, and 10 year debt rolls over. The more immediate consequence involves the funding of the federal government. Powell has reiterated several times that monetary policy (the Fed’s interest rate decisions) won’t be dictated by the needs of fiscal policy (government spending decisions). Stan believes that entitlements will eventually get cut. At the moment we are seeing higher taxes and fees first. Either way, it is obvious now that government interest payments are out of hand.

It feels like a lot of momentum politically and geo-politically that started slow is picking up steam. Vivek really took center stage in the most recent debates. New House Speaker Mike Johnson seems to understand the politics of not interrupting your enemy while they are making mistakes. Now the middle east is uniting. De-dollarization was the big headline but in truth, it is De-Americanization that is taking place. It reminds me of Hemingway.

Can you speak more to your comment about "higher taxes and fees"? It wasn't clear to me how the link explained it (what I got from it were the inflation adjustments to tax brackets).