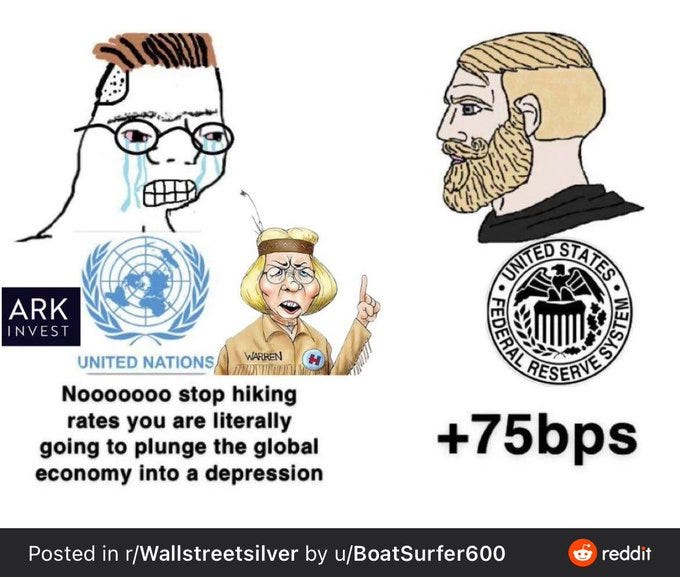

The Fed continues to up the ante. In the face of the UN, the democrats (like Liz Warren), and the litany of “traders” (looking at your ARK) begging for the pivot, Powell went ahead with another 75bps. The full press release can be read here. There was no dissent. All voting members voted for the raise.

The most interesting thing about the meeting was the press conference. The statement was somewhat dovish. It had a “we’re thinking about thinking about pivoting” vibe to it. Once the presser opened up, Powell went full hawk-mode.

He fielded the normal lame questions but there were a few that stuck out. When asked about 50bps increase in December Powell left the door wide open, “It’s about the pace, what level we get to, and how long we stay there”. This tells me that the Fed continues to see the numbers for the CPI and employment come in and are frustrated that nothing has budged yet.

Powell also commented that they want the policy rate where the real rate is positive. This means that the fed funds rate has to be higher than the inflation rate. With inflation last clocking in at 8.2%, the Fed has a long ways to go. With this meeting, the Fed funds rate is now 4%. This means we are halfway there. We all know that the inflation numbers are worth as much as points during “Whose line is it anyways”.

But it is the metric that the Fed has tied their ship to. Now they have stated that they intend to follow through with more increases until the numbers improve to their liking.

After Jackson Hole, Kashkari was ecstatic about the market turning deep red. I highlighted this in a post back at the end of August. Now during today’s presser, a reported lied to Powell about the equity markets being up. This lit a fire under Powell. He severely talked the market down, which proceeded to crash into the close. This really sealed the deal of being the most hawkish conference of the year. The big take away, the Fed is not done here folks. Pivot is delayed until further notice.

Anyone that is still long growth, this was your warning that the bottom is not in. Powell and Co are not done here. Anyone claiming that we’ve hit bottom and that the pivot is coming is delusional. From this press conference, I’m saying it right now, we will have zero money supply growth until further notice. Powell has turned off the printer. He has locked into the idea that Volcker had at the end of the 70s. This is going to end very badly for some (looking at you pension and insurance funds). It will also put the government in a serious situation concerning funding moving forward.

Your meme skills are the stuff of legends. You had me dying.

Every day the Tom Luongo analysis makes more and more sense. Big players know the trajectory of the past few decades was unsustainable and are finally doing something about it. Great recap & memes as usual.