There was a lot of news this past week and weekend regarding Trump, the DOJ, the FBI, Warner Bros, and Jackson Hole. All of it was just noise. The real signals are coming from Europe and China.

China is currently struggling with the worst drought in 61 years. Droughts are bad news for hydro-power and China is no different. Big cuts are taking place in the amount of power that China’s hydroelectric dams are able to produce. This is forcing them to ration power for their industrial base. This will have big repercussions down the road.

China requires an immense amount of power for their industrial production. It requires a lot of energy for rice, to build solar panels, aluminum, copper, and lithium (which also requires a 500,000 gallons of water to process one metric ton of lithium). Sticking with the lithium topic for just a moment, it seems the “environmentalists” have caught on that mining and processing large amounts of lithium is not good for the environment.

“The world is preparing for a lithium boom, mainly due to the anticipated increase in EV production and uptake over the coming decades. Several celebrities and tech billionaires are backing lithium mining in a bid to support a green transition. In addition, many countries are rapidly developing their mining capabilities to establish their place in the global minerals and metals market, which is expected to expand significantly over the next decade. However, environmentalists are concerned with the damage the rapid expansion that mining operations could cause to the environment.”

So is this a pivot in the “environmentalist” narrative? Are they now going to be anti-electric vehicles? Maybe they should just drop the charade and let everyone know that the WEF doesn’t want you to own any kind of vehicle. This is just another glimpse into the World Economic Forum’s Thanos complex.

Back to China for a hot second. This drought will cause them to rely more heavily on coal, oil, gas, and nuclear for energy production. It will also put a floor on the price of rice, lithium, copper, and aluminum. If there was anything we learned from the government mandated shutdowns of the economy it is that this shutdown will lead to shortages down the road. I expect a selloff in lithium, copper, and aluminum in the short-term then a roar higher.

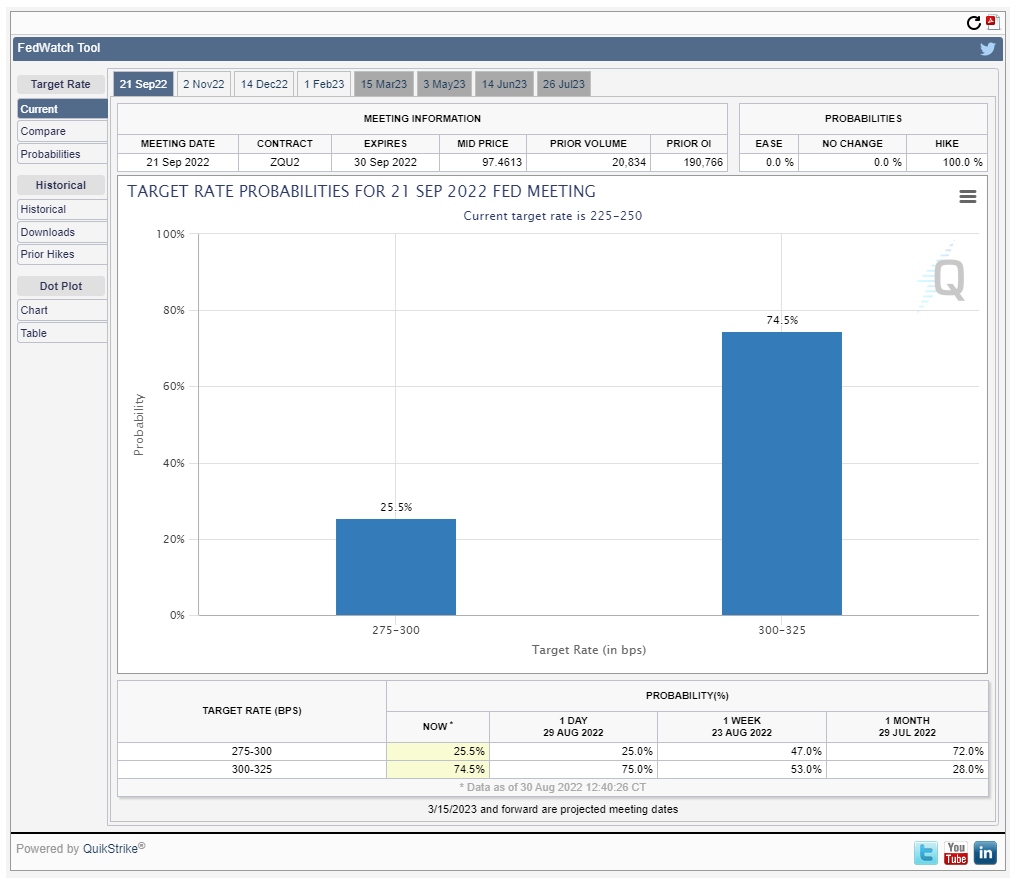

Switching to Europe. While Jerome Powell was giving a speech that lasted about as long as Layla, ECB officials are waking up to the fact that they are screwed. They are now in talks to raise rates more aggressively and to begin a QT program. The Fed is signalling another 75 basis point increase and the CME’s Fed Watch tool has the odds near 75%.

Can the ECB play catch-up at this point? Sure. Will they have the fortitude to do so? Doubtful. This is going to take much larger increases than what the ECB is signalling. High energy costs are devastating the industrial base of Europe. I covered this a week ago in the money supply report.

At the time I was curious if the EU politicians would wake up and realize that they could be the next Sri Lanka. We are now beginning to see this in different forms. Belgian Prime Minister Alexander De Croo has warned that “the next 5 to 10 winters will be difficult”. I’m wondering how long Alex thinks he can retain his position in Belgian politics while his people suffer. Meanwhile German “experts” are warning of electrical grid instability.

“The continued expansion of highly volatile renewable energy sources and the further displacement of more conventional generation units from the market are making the power grid increasingly sensitive to weather-related fluctuations. Unusual weather phenomena such as dark doldrums pose significant challenges to the security and stability of supply to the power grid. The largely intermittent output of solar and wind farms does not correlate with fluctuations in electricity demand.”

Are the “experts” now waking up from the green dream to actual reality?

“The importance of nuclear power plants for security of supply in base-load operation and their and their ability to operate the grid in parallel with renewable renewable energies have been demonstrated. The nuclear power plants appear to be well suited for the energy made to achieve the future goal of carbon-free power generation.”

Watch out now, Germany may have to backtrack on their Atomic Energy Act that would have halted all nuclear power in that country. The Swiss have also caught on that they should “rethink” their nuclear power plans. The Swiss politicians have told their citizens to expect potential energy shortages this winter. A group of lawmakers then formed the group “Stop Blackouts” to launch a petition to revise the country’s energy policy.

""Until recently, Switzerland had safe and virtually CO₂-free electricity production: the environmentally and climate-friendly combination of hydro and nuclear power is to be abandoned for no reason at all"

Nuclear power is going to come into its own. At the same time, the supply crunch in uranium is going to be forcing the price higher.

Finally, Tom Luongo put out a great piece on Monday about the battle between Powell and the ECB. I highly recommend you spending a few minutes reading it in its entirety but I’ll excerpt a few snippets.

I never expected Powell to indicate any kind of pivot talk at Jackson Hole last week. His nine-minute speech was the exact opposite of that. It was a complete dispelling of the illusion that the Fed has any mind to change course any time soon.

By refusing to fold to the pressure earlier in the year and going forward with hiking farther and faster than anyone (including myself) thought they would or could the Fed has placed the ECB into a bind. Powell’s speech at Jackson Hole tightened that bind to the breaking point.

Tom expands on the idea of the WEF shifting their pawns around the board and their mad scramble to keep a grip on their power. He wraps up with this:

“You can’t virtue signal yourself out of a depression of your own making. Those with money will simply abandon you.”

I couldn’t have said it better.

Thanks for the link to Luongo, I meant to check out his site last week after hearing him on the Tom Woods show