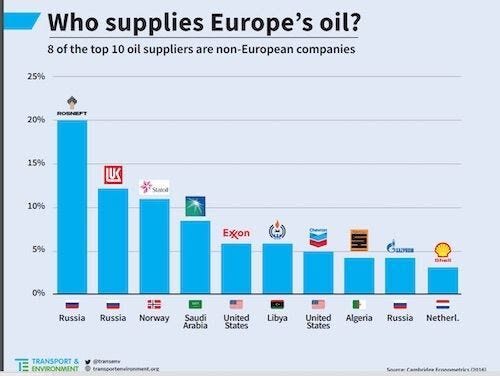

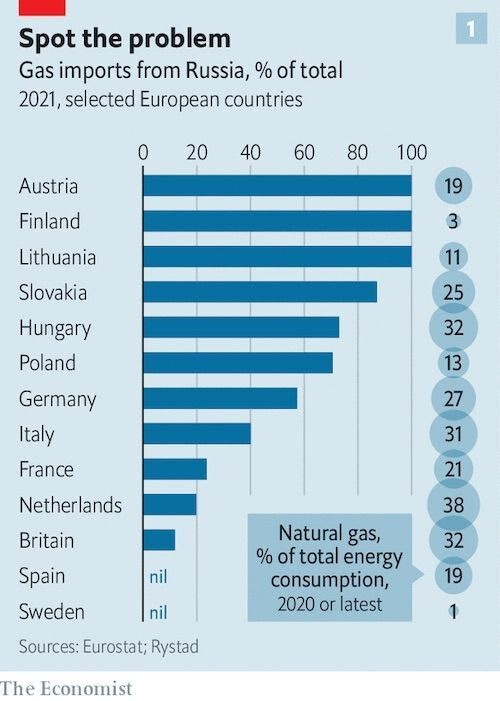

The sanctions that the US is imposing on Russia due to their invasion of Ukraine is having secondary effects that were not considered when these sanctions were announced. Some of the initial reactions were going to be obvious, like oil and gas. There was total confusion over whether Russian oil and gas were going to be allowed to trade on the open market. Many energy trading firms dropped Russia like a hot potato due to this worry. Immediately Russian crude began to trade at a significant discount to the crude oil benchmarks. The major problem here was Europe’s reliance on Russia for oil and gas.

This was a big reason why oil and gas were carved out of the sanctions. Unfortunately the Biden administration wasn’t clear enough on this point and confusion ensued. Now the rhetoric has been elevated. The House of Representatives will hold a vote on a bill which would remove trade relations with Russia and Belarus. It would include a ban on oil imports. It is certain that any kind of ban on oil imports would sink Europe straight into a recession. It could even cause a hyper-inflationary scenario. Because of this, it is highly unlikely that Europe would follow suit. China certainly hasn’t. They are chomping at the bit to buy discounted crude oil to alleviate their own energy crisis. This is the primary reason why RSX and ERUS were so attractive to me. Unfortunately, RSX (like ERUS) has been halted.

I am unsure how a regular investor can gain exposure to Russian companies at this point. With the Russian stock market effectively closed and Russian ETFs halted, there is little one can do. For the big wall street banks, it has been a different story. It has already been announced that they are buying up bonds of Russian companies. Liz Warren was on the war-path about this. She apparently doesn’t realize that wall street doesn’t have morals only profit motives.

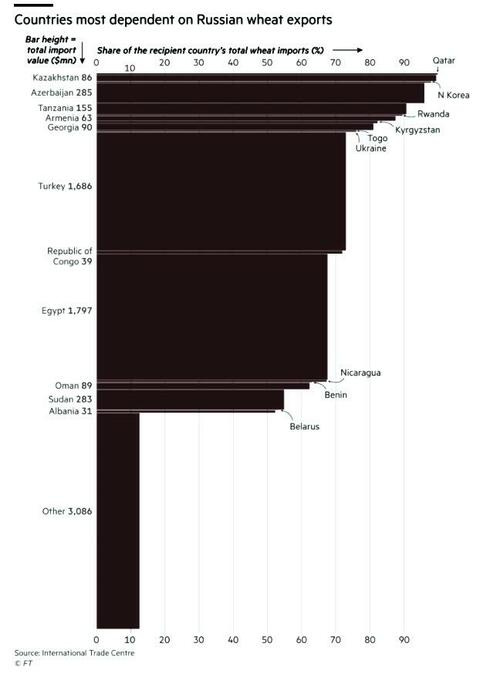

Wheat also had an immediate effect. Ukraine is known as the breadbasket of Europe. Russia and Ukraine together account for roughly $11.4B worth of wheat exports.

Wheat has had a spectacular rise in the past 10 days. It has gone limit up the past 5 consecutively. Now this will have secondary effects. The major one will be significant uprisings. Think “Arab Spring” on a much wider spectrum.

Those countries that are friendly and near Russia should be safe but countries like Tanzania, Egypt, Congo, Nicaragua, Oman, Benin, Sudan could all see profound turmoil. This is not the year to go see the pyramids.

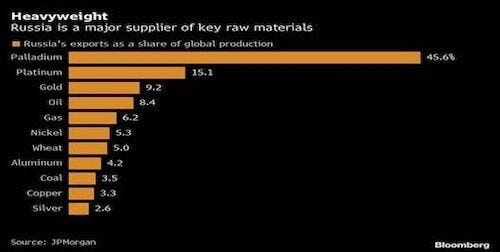

Now other markets are beginning to break down. Today saw the LME Nickel market go parabolic.

Roughly 72% of nickel is used to make stainless steel. The price run-up will put pressure down the line on manufacturers. Just a heads-up, both BHP and VALE mine nickel. Whats amazing about the surge in the nickel price is that Russia only accounts for 5.3% of global production.

Those top three are ripe for a similar run which brings me to gold. Today saw six Russian gold refiners removed from the London Bullion Market Association. The LBMA is THE market for the trading of precious metals. This is where all the major players source their precious metals, GLD and SLV included. By cutting out these 6 refiners, 330T of gold per year will become a toxic asset. Roughly 9.2% of global production. The iShares Gold Trust, IAU, holdings include 10.8% of Russian gold. 7.07% of SLV is Russian silver. GLD holds 2.2%. What happens when this gold and silver suddenly can’t catch a bid?

So how does this end? Russia announced their demands today.

"We really are finishing the demilitarisation of Ukraine. We will finish it. But the main thing is that Ukraine ceases its military action. They should stop their military action and then no one will shoot."

"They should make amendments to the constitution according to which Ukraine would reject any aims to enter any bloc. This is possible only by making changes to the constitution."

"They should recognize that Crimea is Russian territory and that they need to recognize that Donetsk and Lugansk are independent states. And that’s it. It will stop in a moment."

Will the west concede and admit defeat or will they double down in an effort to save face? My money (and portfolio) is on a double down. Hold on to your hats, this will get wild.

RW: "Hug your gold coins"

My thoughts on silver today. Jeremy Irons pounding the table in Margin Call, yelling "this is it!"