This week saw the release of the US inflation data. On Wednesday, the BLS published the Consumer Price Index. The headline number came in at 3.7% year-over-year. This was higher than the expected figure of 3.5%.

This was highly predictable as energy prices have been moving steadily higher since the end of June. According to BoA,

“Headline inflation was boosted by a surge in energy prices (+5.6% m/m) owing to higher gasoline prices. Given further increases in crude oil prices and unseasonably warm weather, energy prices could continue to put upward pressure on headline CPI in the near-term.”

Meanwhile “core” inflation is continuing to deflate.

Tracing our inflation back to the source, the covid lockdowns put a severe crimp in the economy. The government’s response was to hand out helicopter money. Money in the hands of consumers went to buying goods as the service sector was shut-down. Goods prices shot-up and shortages developed. Then the economy was opened back up and consumers began spending on services as they had already splurged on goods. Now services have gotten expensive. I think this is easily seen through BoA’s CPI year-over-year heatmap.

Now I believe goods is going to lead the way for the second wave. Yesterday the PPI data was released and it showed a bounce.

This is the year-over-year rate of change in the costs producers pay.

My belief continues to be that we are going to get a second round of cost-push inflation because no significant developments or progress has been made in the commodity sectors of the economy. I’m talking about oil, gas, copper, steel, aluminum, tin, and softs like wheat, corn, soybeans, etc. The ESG investing movement forced on the market by players like Blackrock have exacerbated this issue to a ridiculous extent.

In the short-term, higher oil prices are going to act as a strain on the other commodities. It takes a lot of diesel to extract copper or tin. Energy is needed to convert iron ore to steel or to manufacture steel into components. I expect market players will initially sell off some of these commodity producers as their cost of goods sold will rise putting pressure on profit margins.

I think it is important to remember that none of this happens in a vacuum. Meaning that other nations have a role to play in the dynamics of the market. When I look to Europe, I see a hard correction coming their way. Their inflation rate is well above the US and yet, the ECB has only raised interest rates to 4% and signaled that they could be done.

This does not bode well for Europe. There is no way that the ECB can arrest their inflation problem with rates at 4%. High inflation will cause a harsh recession as European consumers will be unable to afford to purchase anything more than the bare necessities. This could dampen the effects of the cost-push inflation. On the other hand we have China.

Now I should preface this with a disclaimer. I find it really hard to believe any data points coming out of China. Studying China’s economy requires “a mind less bound by the parameter of perfection”.

I’ve seen quite a bit of anecdotal evidence that China is having a rough go of it and is going to stimulate their economy. This should more than offset the slowdown in Europe.

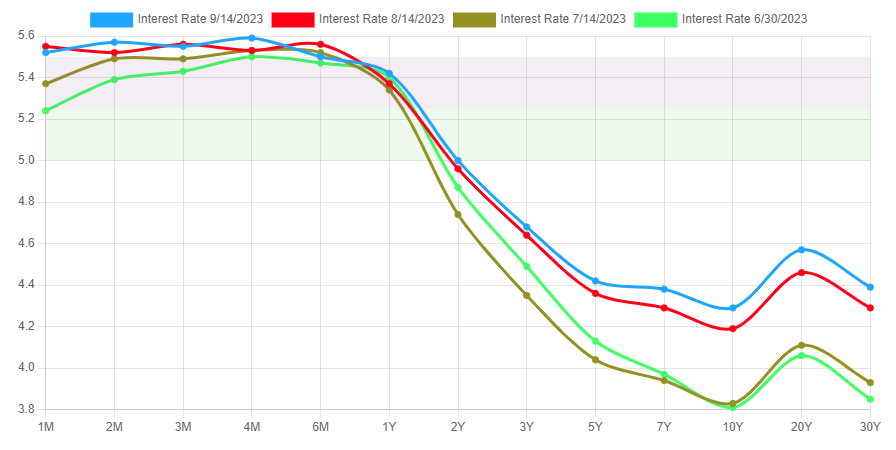

“Keep an eye on the long-end of the treasury curve over the next few days to see if the disinflation trade holds up. My belief is that it won’t.”

If traders truly believed that inflation was over, long bonds would get bid down.

So far, they are continuing to rise which means that treasury bond traders don’t believe that inflation is over yet either.

Excellent commentary as usual Alan! I saw you posted a tweet from Shubham Garg on oil demand, and I know he does a lot of great work on oil, especially Canadian oil companies. I'm wondering if this is something you've researched at all and what your thoughts are on the sector? I own some of the Canadian oil stocks and they seem like a tremendous value here, especially if oil stays strong.

Thanks!

-Paul Fisher