In February 2021 the Federal Reserve switched the M2 data release from weekly to monthly. It is scheduled to be released the last Tuesday of every month. For December 2024, that date was the 24th. Unfortunately for those of us who track it, the Fed neglected to release it on Tuesday and pushed it out to today, Thursday the 26th. Whoops.

The 13-week annualized money supply growth has come in at 7.6% through 12/2/24. This has put current money supply growth solidly into the average range of past decades. Here are the past 10 weeks:

Average monthly growth in December is 8.76%, so we are very close to average already in the first week of December. December is also the month with the most times money growth on a 13 week annualized basis has exceeded 10.5%.

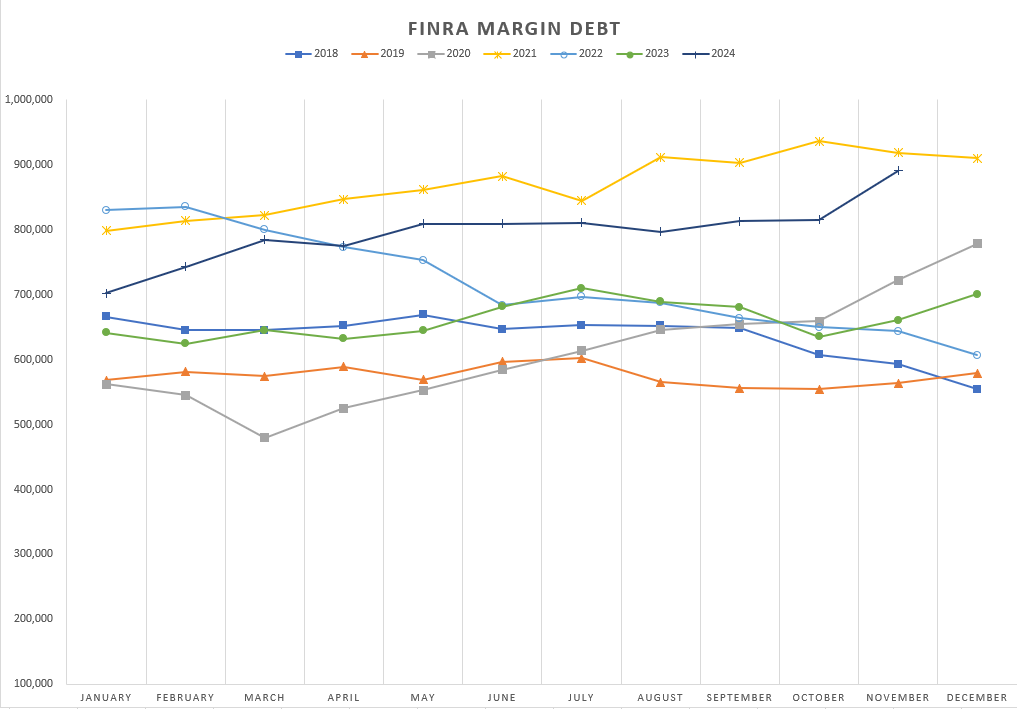

I’m looking for follow-through with the M2 13-week annualized money growth and with margin debt statistics.

“Margin debt use was up 9.3% month-over-month to over $890 billion. The month-over-month size of this increase is a rare feat. Margin debt statistics have only been kept since 1997 but during that time, a month-over-month increase of 9% or greater has only occurred 11 times (a 3.58% occurrence rate).”

In addition to money supply growth and margin debt, I’m following a few quant studies. First is the Zweig Breadth Thrust, brought to my attention by Seth Golden of the Finom Group.

“The Zweig Breadth Thrust, developed by renowned investor Martin Zweig, is a powerful technical indicator used in stock market analysis. It measures market breadth by analyzing the percentage of advancing stocks relative to declining stocks over a specific period, typically 10 trading days.

Another study I’m watching is Wayne Whaley’s TOY Barometer.

“What he found was there was a high correlation between the S&P 500’s returns between November 19th and the following January 19th and the S&P’s performance the 12 months following January 19. And since the 2-month period straddled the turn of the year (TOY) and the gift giving season, he called it the TOY Barometer.”