Checking in on the "keys" to the market

Nearly two years ago I wrote on what I thought were the “keys” to understanding the market. You can find the link to that article here. In it, I laid out why I thought the yield curve, money supply, and margin debt were important to watch. I still believe these keys hold power to understanding the market but that timing when they will become important is better determined by technical analysis.

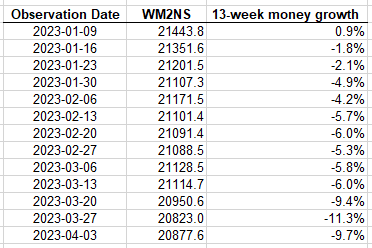

For instance, we have seen money supply stagnant for 48 consecutive weeks.

Here is the past 13 weeks’ worth of numbers:

It is typical to see a lull in money growth at the end of the 3rd quarter and the beginning of the 4th but this has been exacerbated by the Fed’s already dramatic policy of holding the money spigot firmly closed.

The year-over-year figures look downright absurd. I find it very hard to believe that this won’t cause some kind of dislocation in capital markets. I think we are already seeing it take place in the real estate market.

Today the Case-Shiller Index posted a 2.0% increase year-over-year. This is the slowest increase in national home prices since August of 2012. While the overall picture is still positive, regionally the west coast is having a tough go at it.

San Francisco and Seattle are both negative in the year-over-year price index while New York and Miami are still positive. In real estate location is everything. We can see that this still holds true. While the contraction in the money supply will impact all regions, some regions will fare the storm better than others.

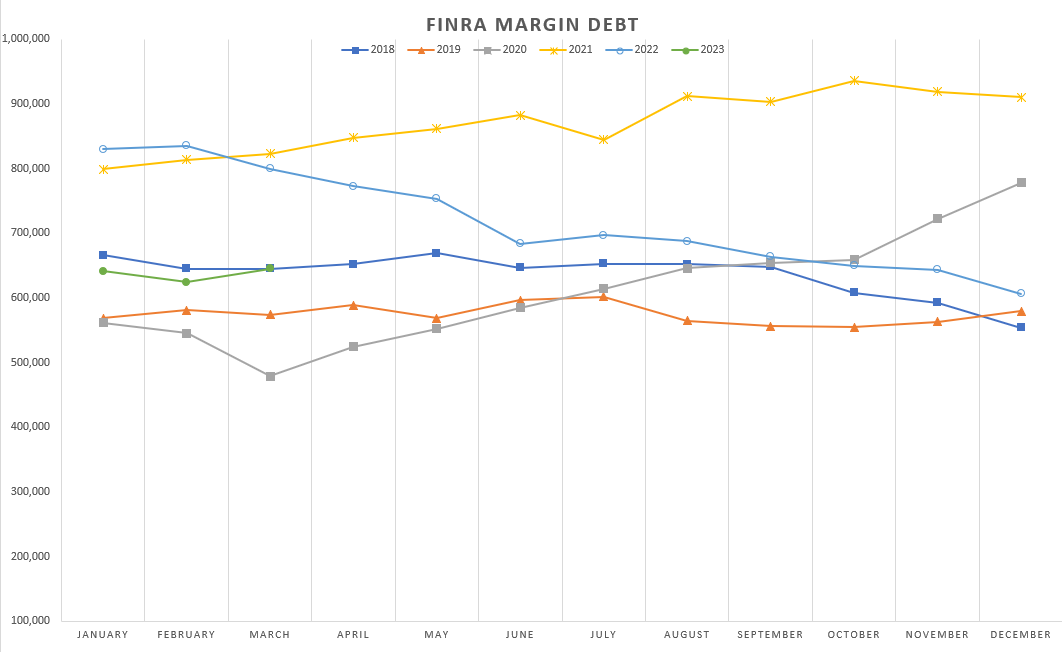

While the money supply has remained stagnant, margin use among traders has also remained sluggish.

This shouldn’t be a surprise as the market is within 60 points of where it was this time last year. Traders have been whip-lashed back-and-forth for a year. I’m actually surprised it isn’t less.

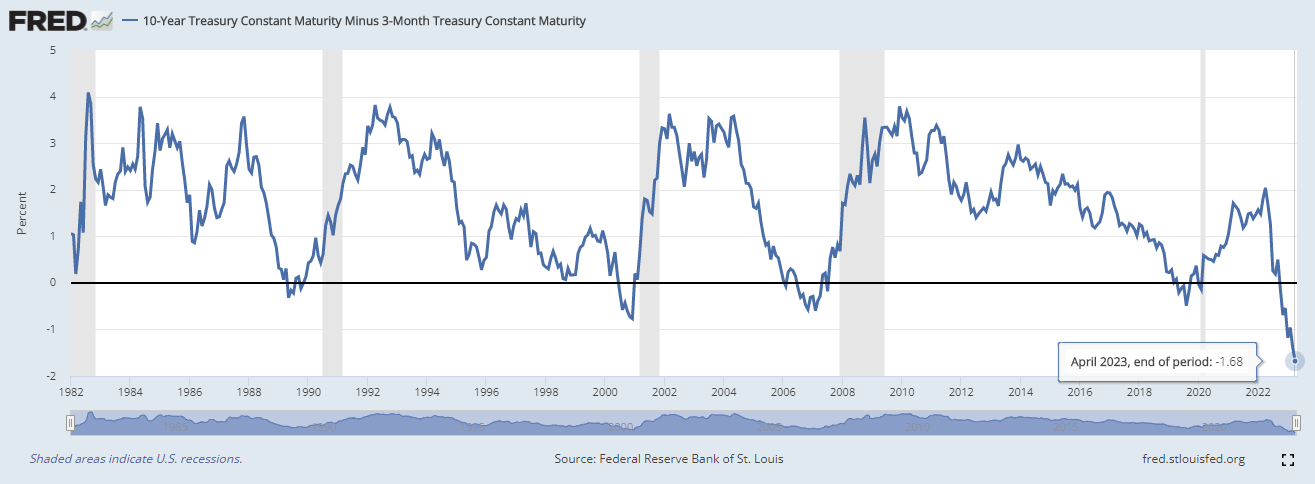

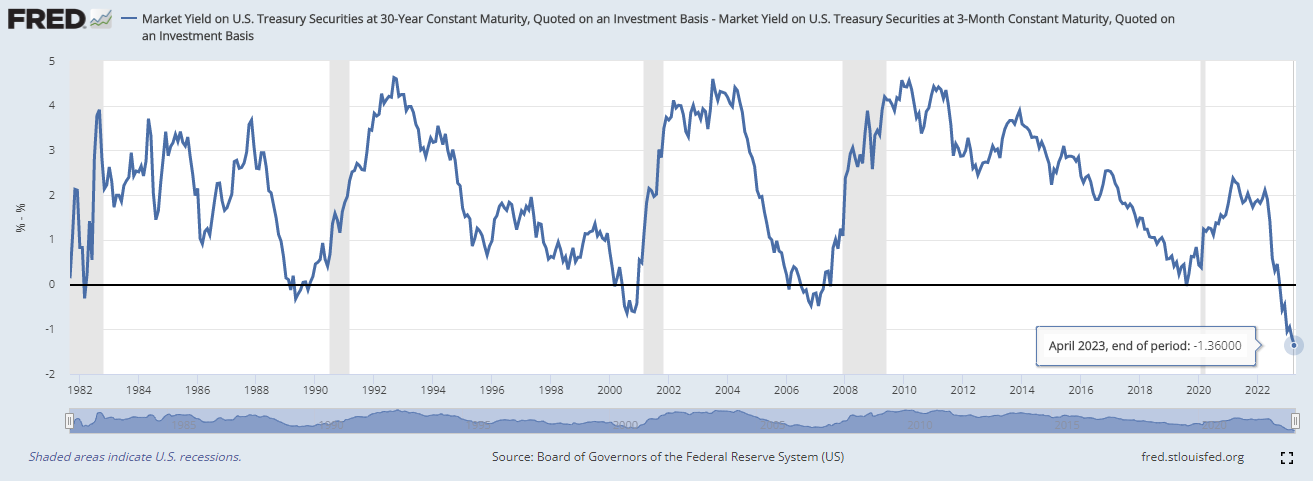

Finally, the mess that is the yield curve.

We have a serious inversion. It is one of the worst in history.

Now I attribute some of this dislocation due to the worries surrounding the debt ceiling debates. It has pushed the 3 month yield to 5.2%. I also attribute some of the distortion to the Treasury Secretary who has been running her own operation twist which has suppressed long rates and caused short rates to rise. Whether Janet Yellen has done this on purpose to force the Fed’s hand to pivot or if she is oblivious to the consequences of her actions is up for debate. What is not up for debate is that we are going through a serious period of transition.

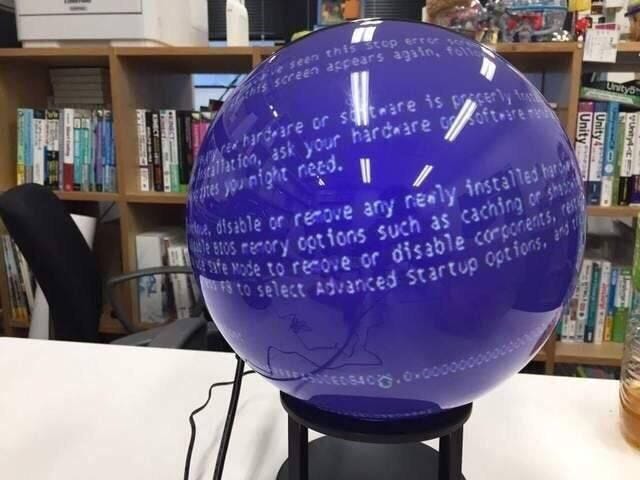

While the above keys have the hallmarks of a brewing market contraction, my crystal ball is not fine tuned. At best it lets me know that pain for the general market is coming. I believe that my capital is best deployed in companies that are geared towards the commodity markets which have been under-served by capital long enough to create opportunities for significant future cash flow.