The CPI came in under expectations this morning. Headline declined 0.1% month-over-month after increasing by 0.1% in the previous month. Annually, the CPI came in at 6.4% versus 7.1% in November. This came in under the forecast of 6.7%.

The headline figure is quickly catching down to the “core” number as energy costs have retreated.

I had pointed out during last week’s wrap-up that:

“The Fed was slow to react to inflation on the way up. It would only make sense that they would also be slow to react to inflation on the way down.”

I expect the same from market participants and forecasters. I don’t believe market participants are fully understanding how serious the Fed is here. A big deflationary shock is on deck. We are starting to see it in the heatmap from BofA:

The decline was largely driven by lower rates of inflation for new/used cars, energy, apparel, and medical care. This was buoyed by higher rates in the services category. Karl Denninger at Market Ticker had this to say:

“Second, services less energy services, which is the general service inflation index (remember, we're a wildly-service based economy) was up 7% annualized and that has not relaxed at all with last month up 0.5% on the month which is basically flat on the current run-rate. That is three times the claimed "target" Fed rate.”

So while the big mainstream financial press headlines might reflect that inflation is “retreating”, under the surface we are still looking at major distortions that will have profound economic consequences.

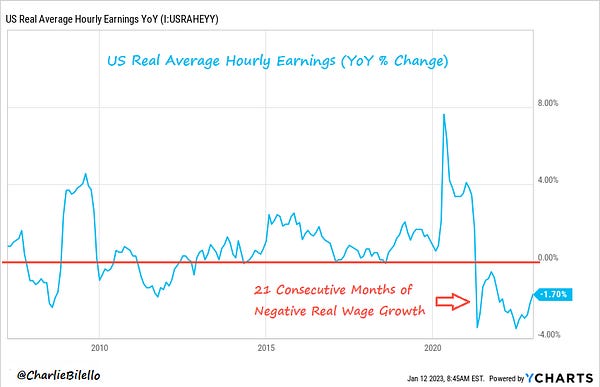

The biggest one is that wages are still not keeping up with the rate of inflation. This really puts consumers in a bind and signals lower earnings for discretionary goods.

According to the CME’s FedWatch Tool, the market is pricing in a 25 basis point increase at the FOMC’s February 1 meeting. At 94.7%, it is weighted too heavily in that direction. I believe very strongly that Powell and Co are going to use this meeting to send a strong signal to the market and raise the Fed Funds Rate by 50 basis points. The Fed heads have been very adamant that they want to see inflation squashed. The market continues to not take them seriously.

Michael Burry tweeted what he sees happening and I think it ties in well with what I see too: