The latest numbers are in and the flood of liquidity that the Fed unleashed on the economy has slowed to a trickle.

The money supply took a big dip at week 13, getting down to 3.22%. It has since bounced back. It is following the traditional pattern of past years. This is a dangerous time for the capital markets. The sluggish money supply growth will lead to weakness in the stock and bond markets. This is because you need expanding money growth to compensate for the rise in prices in the capital sector. To feed new all-time highs in the stock market, you need all-time highs in money creation and we just aren’t seeing that from the Fed at this time. Here is a summary, year-to-date, of the past money supply numbers:

Previously I speculated that due to inflationary costs in the building process that homes would remain elevated in the event of a stock and bond market correction. My view is still the same. Today saw the Case-Shiller index hit a new all-time high.

However, the data coming out of Redfin shows that housing might be hitting a soft spot.

We are hitting the primary house buying season. It is a strange phenomenon to see an increase in price drops at this time. They have climbed nearly a percentage point since the beginning of March. This goes against the normal market flow for housing at this time of the year. However, this may be more of a reflection of the median listing price than a slowing of sales.

Prices look to have finally leveled off. I imagine a slight correction will be in the works but inventory and median days on the market would need to see big reversals.

The high cost of purchasing a home is getting more expensive as interest rates rise. We are seeing more and more families being priced out of the market. This gets reflected in the number of new home sales data figures which are down. However, the big fish (looking at you Blackstone/Blackrock) are continuing to gobble up inventory. At some point something has to give and when it does, a major correction will be unleashed.

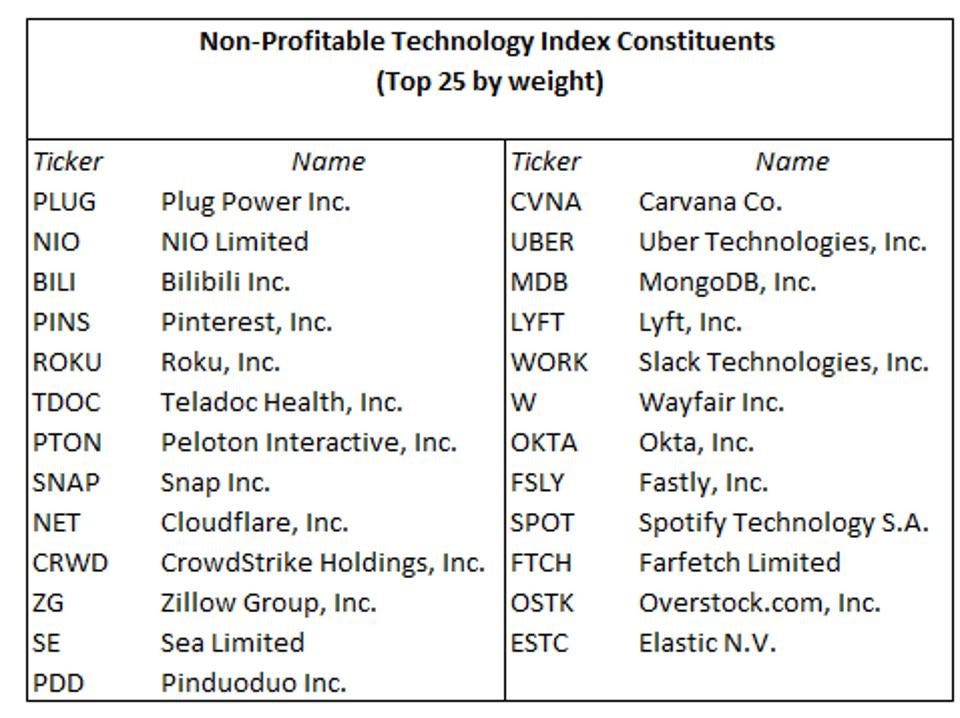

Taking all this in, I’m still not going full bear-mode on the stock market. However, I’m taking a strong look at buying puts on unprofitable tech. These stocks are already trending lower and would descend even further if a major correction took place.

So is there an etf or something that is simple to invest in to short non-profitable tech companies?