Last week saw the CPI and PPI drop below expectations. First the CPI:

It was touted as 4.9% at the time, which was under expectations of 5.0%. In reality it met expectations. This was the ninth consecutive lower print in a row. The monthly changes showed that on balance everything was a wash. Drilling down we see that used vehicles, gas, car insurance, and rent all pushed higher.

“Core” CPI continues to be “sticky” at 5.5% which met expectations. On the PPI side, April’s numbers came in at 2.3% year-over-year and “core” at 3.2% year-over-year.

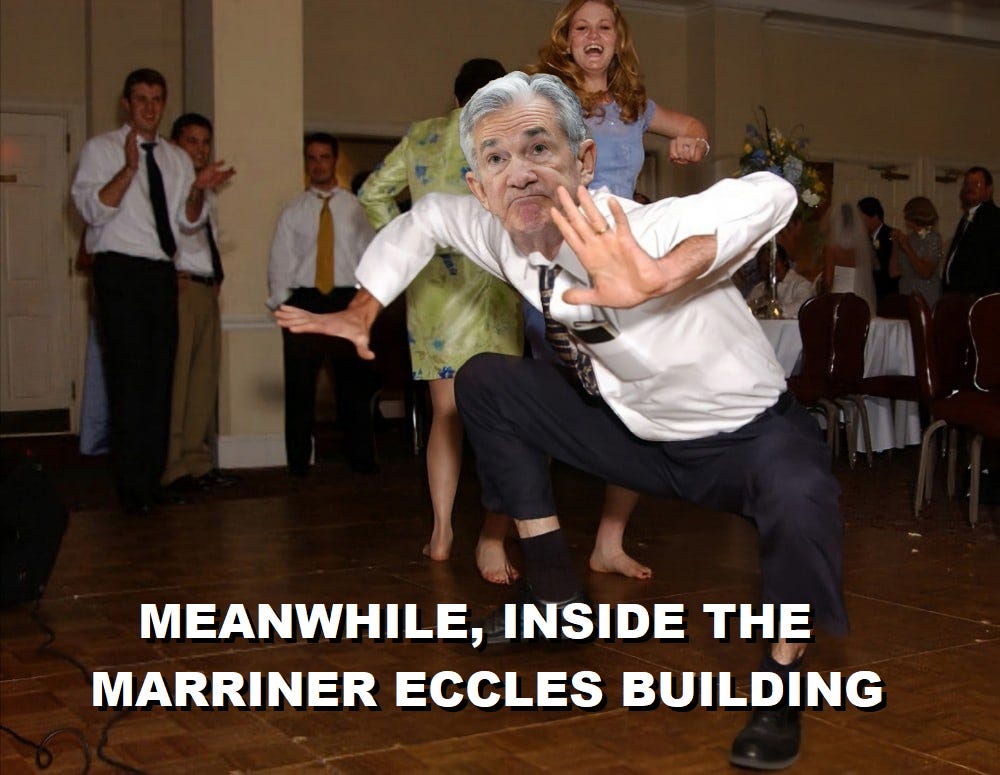

To me, these figures give Powell and Co runway for a steady diet of 25 basis point increases. The market is largely under the impression that “The Pause” is upon us and that the Fed will start cutting rates after the June meeting. I find this to be more wishful thinking from the mainstream.

A CPI figure of 4.9% is still more than double what the Fed has signaled as their goal. The good news is that we have positive “real” rates. That is, rates that are above the rate of inflation. In the past, this would signal that inflation is coming under control. My concern is that we haven’t seen any commodity or industrial development that would show that these key components will be available in abundance. I continue to see reports of tight supply for copper, oil, and tin with natural gas and coal on deck. This could be an extremely dangerous time for the broader market. We seem to be slipping into a deflationary environment with tight commodity supplies. Maybe the Fed needs to pick up an economist who is an expert in deflationary studies.

Hee, hee! At least he has deflation experience!

That economist will be the GOAT. He'll destroy the Fed Put, consign Keynesianism to the ash heap of history, end fractional reserve banking, and make gold and silver great again!

JPow will need to pay him a pretty penny to lure him away from Fox Sports, though.