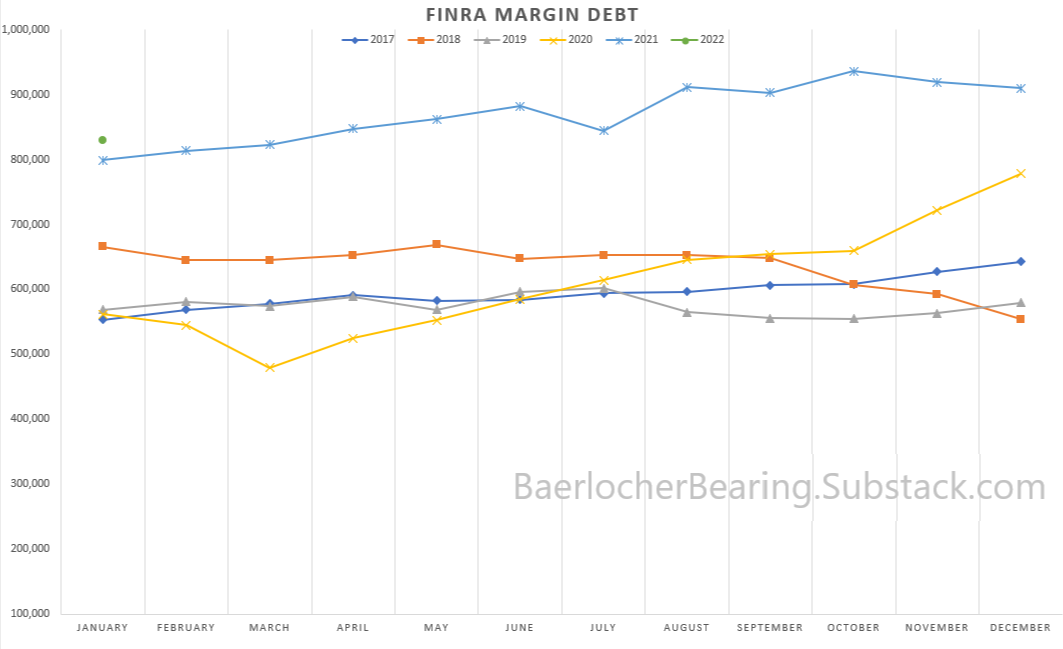

Margin debt data was posted earlier in the week by FINRA. Tracking margin debt is one of my keys to the market. Margin debt is when traders use their portfolio holdings as collateral to borrow money to buy more stocks. This tells me how confident traders are that stock prices will continue to rise. It can cause a market to get hot really quickly but it also works in reverse. If margin debt starts to drop it can lead to a cascade of selling.

The latest data shows that there has been a continued drop in margin debt use. Since it’s recent peak at $935 billion in October it has continued to slope down.

October $935 billion

November $918 billion

December $910 billion

January $829 billion

This continued selling has put extreme pressure on the major market indices. They are all down from their peaks. Selling begets selling especially when traders are so levered up on margin debt. With the way the margin debt is going, I would not be surprised to continue to see downward pressure in the general market. I’m not going to begin taking short positions until I get confirmation from one of the other keys to the market but it is not looking good. The money supply and yield curve are now very important to monitor.

Traders have continued to stock up on cash in their portfolios. The latest data on the “cash-on-the-sidelines” shows traders holding $248 billion in cash.

This is down slightly from the end of the year figure of $250 billion. If this money gets deployed into the market, it could be a huge wave higher in the indices. That does not seem to be the trend, however. Traders have been building a war chest of money since July of 2021. This is another indicator that there will be some extreme volatility in the market moving forward.

Portfolio Update

ZIM Integrated Shipping has had a stellar run. It has grown to dominate my portfolio. At this point I am selling covered calls against the shares I own. For these covered calls, I’m selling March 18th expiration. I don’t want to sell anything past their earnings date as I don’t believe the shipping story is over yet. ZIM’s next earnings report is expected on March 28th.

UUUU Energy Fuels and NXE NexGen Energy have both struggled. Both have made round-trips for me and I’m near where I first got in. UUUU added a rare earth division and I believe it puts them in a great position. I’m still a believer in the uranium story. We have an impressive setup for a long run higher. I’ve sold some covered calls on these positions but it is hard to get excited about doing it. They are worth so little on a per contract basis. Earnings for both companies are estimated for March 21 (UUUU) & March 17 (NXE).

BHP and VALE. I realize that I’ve not really dug into details on these two. They are both miners who pay large dividends. They engage in the exploration, development and production of; oil and gas, copper, silver, zinc, molybdenum, iron ore, gold, coal, and other basic materials. Both bottomed around mid-November and have had a steady run higher. I expect this to continue as inflation runs hot. An alternative to these two companies is the SPDR Global Natural Resources ETF (GNR). In addition to BHP and VALE, GNR holds Exxon, Chevron, Freeport-McMoRan, and others.

I have started a position in GDXJ. This is the junior gold miners ETF. I was selling puts on it and one hit. Now I’m selling covered calls. I plan to utilize the wheel trading strategy here with selling covered calls and puts. If you are unfamiliar with how this works, you can find a quick tutorial here.

I’ve started to accumulate shares of Dorian (LPG). I gave a brief overview of my thesis for this company here. The cliff notes version is that Dorian is a shipping company but they only ship liquid propane gas (lpg). They are able to easily convert their ships to ship natural gas but have had great success with transporting lpg. They have an impressive amount of cash on their balance sheet and a group of executives who have bought into the company and are motivated to get the stock price higher.

Ramaco Resources (METC) is a metallurgical coal miner who has had back-to-back earnings beats. Metallurgical coal is a key component to converting iron ore to steel. Something the “greenies” don’t understand is that their precious wind turbines are made with an immense amount of steel which requires metallurgical coal. I outlined the basics for coal and natural gas back in September of 2021. Nothing has changed between then and now. The ESG investing formula is only making these resources achieve higher prices.

I’m holding calls on USO with two different expiration dates. Oil has been on a hot streak and the continued war rhetoric has only exacerbated it’s rise. It is beginning to reach a point where it becomes a political pawn. We’ve seen this with the token gas-tax holiday proposed by the moderate democrats. I do not hold calls for long periods of time. My typical holding period on call options is 15-45 days. I may make an exception with the January 2024 expiration call options. The setup is too rich. We are experiencing near zero capital expenditure development in the oil and gas field. On top of this, OPEC is quickly reaching the limit to how much they can produce. This is only going to continue to drive the price higher. Another factor to look forward to is the summer driving season. The past two years has seen an explosion in the amount of RVs purchased. Many still wanted to take a vacation and knew that the airline customer service would be unfriendly at best and downright nasty at worst. I believe many retiring boomers also invested in an RV to travel. This summer I expect we will continue to see this trend play out and summer gas usage should be above normal. 2019 and 2021 both saw price increases in gas over the next two months.

In addition to my stock portfolio holdings, I hold physical gold and silver. I recommend a minimum of 10% of your stock portfolio in physical gold and silver holdings. I own an assortment of different gold coin weights. I also have 1 oz silver rounds. I buy from only those I trust which include American Coin & Vault and Craig Rhyne of the Washington Gold Exchange. I do not have any endorsement deals with either of these groups, they simply have provided me with the best deals and customer service. I have recently been adding Morgan Silver Dollars to my collection. I have found these at local pawn shops, dealers, and trade shows. The next show in the northwest is on March 19th and 20th at the Greyhound Event Center in Post Falls, ID.

Finally, I want to address food prices.

I first started talking about food prices back in July of 2021 with my report on my local farmers. I then had a follow-up at the end of the year. I anticipate to continue this series with a new post in the early spring when farmers get back into the field.

It seems that the soft commodity field is as tight as ever. Wheat (weat), corn (corn) and soybean (soyb) prices have stepped right into a raging bull market. I have been watching these as well as agriculture inputs. Companies like Mosaic (MOS) and Nutrien (NTR) are on fire. Final processors have been mixed but Tyson Foods (TSN) has also been on a hot streak.

I expect this trend to continue. This will exert a lot of pressure on the CPI. High food prices can become very political, very fast. The high price of food has led to more than one revolution on this planet. I expect we could see more of this as prices get out of hand.