McCarthy ousted, the yield curve, and oil

After getting the government funded for another 45 days, McCarthy did not survive the motion to vacate led by Florida Rep Matt Gaetz. In theory, this should put a halt on future government spending. Any spending that has already been allocated will continue. In typical congressional fashion, I predict this gets solved at the 11th hour, 45 days from now. It will require a new speaker and that is what the mainstream press will get to talk about for the next month…

to keep everyone’s eyes off of what Janet Yellen is doing to the US debt.

The yield curve made a massive move in September and rapidly accelerated the normalization pace. This no thanks to our Treasury Secretary who is at the helm watching US debt eat up a considerable portion of the government’s budget.

The blame isn’t entirely Yellen’s as her predecessors failed to issue long-term debt when rates were low but Janet takes this to an entirely different level with her outlandish increase in shorter term treasury issuances.

I had predicted a correction in the oil market on the 22nd and it certainly looks like it has arrived in force.

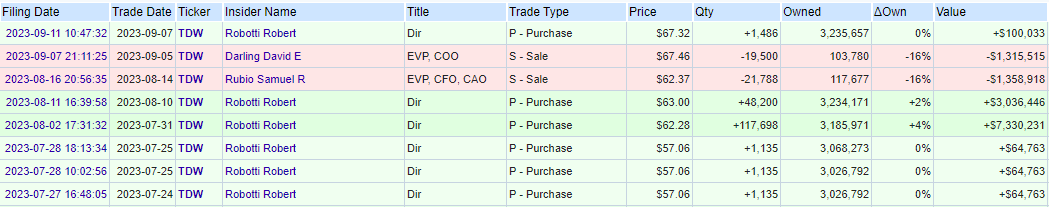

I am adding to my favorite oil based names here. Robert Robotti at Tidewater feels the same way and has been adding recently.

He has purchased over $10M in stock of TDW at roughly the current price. That sounds like a substantial amount of money for someone who already owned 3M shares. Might he favor returning money to shareholders at some point in the future since he owns so many shares?

I feel safe adding as Yahoo is already begging for “demand destruction”.

I don’t think we are at “demand destruction” yet. This is simply a breather before the next leg up. This winter forecast is going to play a part in the oil price over the next quarter. There could be a lot of gas-to-oil switching for energy generation purposes, especially in Europe. I believe this could be Europe’s “winter of discontent”. We’ve witnessed a severe loss of confidence in the euro since July.