Yesterday, the Producers Price Index was lower for the fourth month in a row. The October figure for final demand came in at 8.0%.

This was below the consensus estimate of 8.3%. On a month-over-month basis, the PPI increased 0.2% and “core” PPI was flat. This is the lowest the PPI has been since July of ‘21. Traders took this as good news that the Fed might step down the pace of their rate hikes. It was a sea of green. Then today happened.

Retail sales came in hot. From Trading Economics;

“Retail sales in the US surged 1.3% month-over-month in October of 2022, the strongest increase in eight months, after a flat reading in September and beating market forecasts of a 1% gain. Sales at motor vehicle dealers were up 1.3% as supply chain constraints have been easing while rising gasoline costs pushed sales at gasoline stations 4.1% higher.”

Retail sales don’t adjust for inflation. In reality, what we are seeing is a mirage. When accounting for inflation, retail sales have been flat.

How has this mirage taken place? By credit card use. Yesterday Capital One Financial’s stock sold off after they announced a rise in credit losses. These are write-offs when borrows are unable to pay.

Traders sold the market today in anticipation of a stronger response from the Fed and it is well deserved.

Fed Governor Chris Waller spoke at an Australian investment conference on Monday and had quite a bit to say.

“It’s good finally that we saw some evidence of inflation starting to come down, but I just cannot stress, this is one data point”

“We’ve seen a couple of these before where it looked like inflation was turning and it took back off, so we’re going to need to see a continued run of this kind of behavior and inflation slowly starting to come down, before we really start thinking about taking our foot off the brakes here.”

“So everybody should just take a deep breath and calm down. We’ve got a ways to go yet.”

“We’re not softening. We’re looking at moving in paces of potentially 50 at the next meeting or the meeting after that”

Nick Timiraos, the Fed whisperer, was on it.

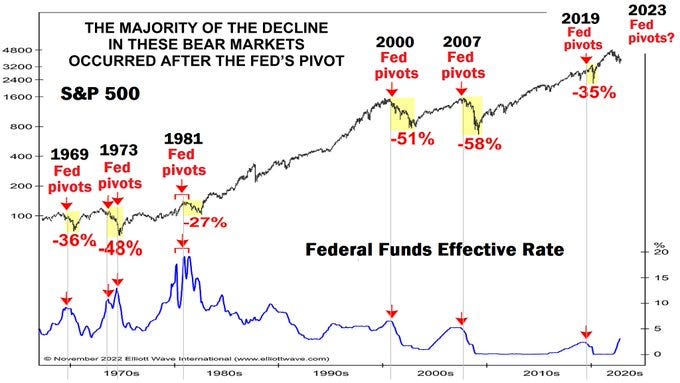

Something to keep in mind here is that when the Fed does “pivot”, it will be painful.

Last night, Michael Burry sent out a rather cryptic tweet and then deleted it.

We could be getting very close to the next leg lower. I think a lot of this will be due to forced selling. Yesterday was the drop dead date for individuals to notify hedge funds that they would be withdrawing capital at the end of the year. This gives time for hedge funds to exit positions to raise capital to meet these redemption requests. This should provide some amazing opportunities. I plan to have cash ready to buy any opportunities that look ripe.

Isnt the pivot always 6 months to 1 year behind due to the money moving through the system lag? This would explain the fall after the pivots

Alan, any thoughts on the CLR purchase by Hamm? Is it expected to go through?

Tender offers are due on on Monday. Is it better to not respond and see what happens?

Edit: Just found an old response you provided on this, where you mention Hamm owns 83% of the shares. If so, it is sure to pass.