There are few things tighter than the labor market right now

a look at SIVB and a reflection on Powell's testimony to Congress

To say that the labor market is tight is an understatement. This week saw multiple job and employment figures and all have paved the way for the Fed to continue to tighten monetary policy.

Wednesday the JOLTS report showed that the US had 10.8+ million job openings. Comparing this figure to the unemployment statistics, there is currently 1.9 job openings for every unemployed worker.

And while this is a decrease over the past few reports, it is still well above the historical norm. In addition, this was the fifth consecutive month that the actual figure beat expectations. Zerohedge reported that if you look further back into the data, the actual figure beat expectations “an unprecedented 27 of the past 29 prints”.

I think this just goes to show how stubbornly high job openings have been. Forecasters continue to believe that we will revert to the mean on openings but the labor force has shifted and that hasn’t been taken into full account. We are seeing a very large generation of people (the boomers) embrace retirement.

The labor force participation rate for people over the age of 55 has dropped by 2% since January 2020. That equates to roughly 1.25+ million people leaving the workforce. Here is the labor force participation rate for those over the age of 55.

1950 + 55 = 2005

I would consider anyone born between 1945 and 1955 as the early portion of the boomer generation. They reached 55 between 2000 and 2010. Later boomers (those born between 1955 and 1965) reach 55 between 2010 and 2020. In earnest, I believe most people are going to target age 65-70 to retire. Simply add 10 years to the above calculations to get that estimate and you’ll see that early boomers hit that age in 2010 to 2020 and later boomers are hitting that age now through 2030. With this rate of retirements, it should be no surprise that openings have remained high.

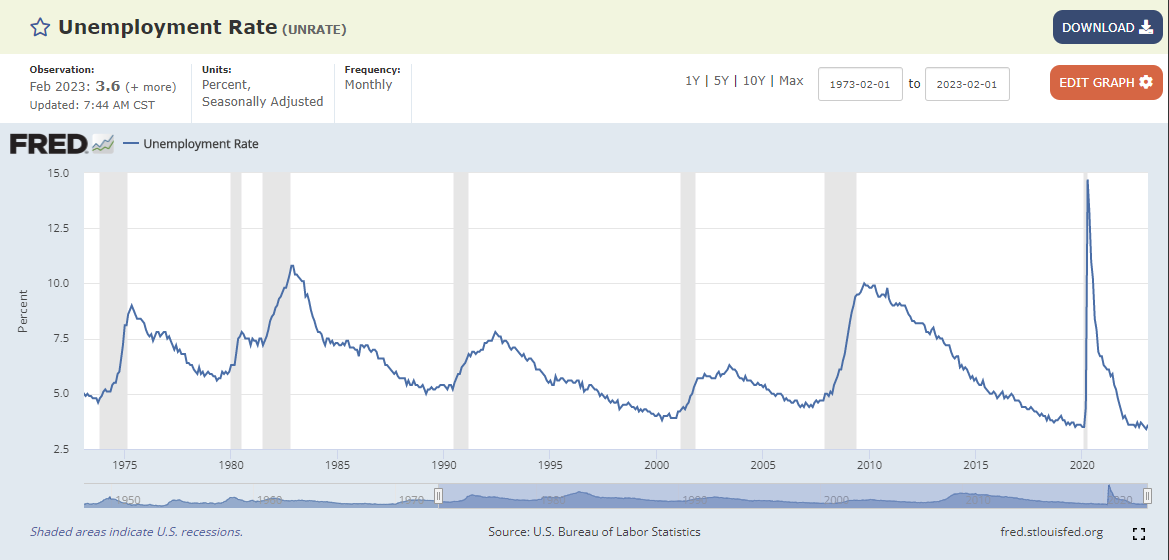

Today saw the release of the unemployment rate, which saw a small uptick.

At 3.6%, we are still at historically low levels of unemployment. According to Trading Economics:

“The unemployment rate in the US edged up to 3.6 percent in February 2023, up from a 50-year low of 3.4 percent seen in January and above market expectations of 3.4 percent. The number of unemployed people increased by 242 thousand to 5.94 million and employment levels rose by 177 thousand to 160.32 million. The so-called U-6 unemployment rate, which also includes people who want to work, but have given up searching and those working part-time because they cannot find full-time employment, rose to 6.8 percent in February from 6.6 percent in January.”

There is a confluence of factors here effecting the labor market. We have a large population moving towards retirement and leaving the workforce. At the same time, the younger generation has embraced the “gig” economy. This has put considerable strain on businesses who are desperate to find help. Wage rates continue to ratchet higher.

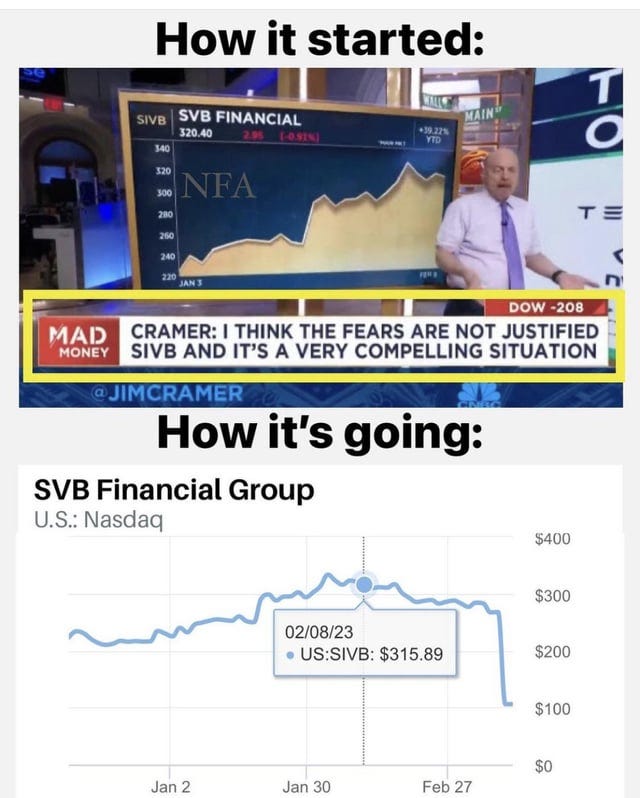

This all makes for a precarious balance in the economy. The last couple days have seen the VIX run higher and an over-leveraged bank collapse.

Silicon Valley Bank (SIVB) got itself into a world of problems. They had significant exposure to the venture capital industry. This industry is experiencing major strain. Their holdings in pre-IPO, unprofitable companies have not been properly marked-to-market on their balance sheets. As interest rates have moved higher, these companies are being exposed for the cash furnaces that they are.

There are a few commentators out there that believe that the failure of Silicon Valley Bank could lead to contagion. That more banks will fail. I have no doubt that we will continue to see businesses fail. Those that are over-exposed or have over-lent to unprofitable companies will feel considerable strain. Rolling over high debt loads at high interest rates is going to be impossible if a business can’t pay that debt serving. They will fail but if you think that a few business failures are going to deter Jerome Powell, you have not be paying attention to what he has been saying.

Chair Powell does not care about the labor market at this time. He made that clear to Congress this week. It is simply too tight. However, since it continues to stay tight, it is allowing him room to continue to reduce the balance sheet and raise interest rates. Many crocodile tears were shed about putting people out of work but the Fed’s focus right now, is on price stability. How is the Fed going to ensure stable prices if they pivots? Powell has repeatedly said that the Fed has learned their lesson and they will not relent until inflation is back to their goal. In addition, they will not be adjusting their goal. Stuff will break. This is not going to be smooth. Powell has told us this.

In addition, he told Congress to get their act in order. Several might have missed this but Jim Bianco did not.

Powell is telling Congress to get their act together or they are going to go for a ride. No one wants to see sovereign debt fail but the Fed does not consider the cost of borrowing for the United States when making interest rate policy. He made clear that the debt is not unsustainable but that the path is. This reads loud and clear that Congress needs to get their act together and stop spending like drunken sailors. The Fed is not here to bailout Silicon Valley Bank, they are not here to bailout unprofitable tech, and they are not here to bailout Congress. As long as you believe that Powell will keep his word, more turbulent times are coming.

My gut feeling is that SVB is not The Big One. Financial conditions are still too loose. I still don't think the economy has fully digested all of the helicopter money/Trumpbuxx from 2020; this is why the Fed needs to suck about $2.4 trillion out of the economy (in the form of reverse repos) just to maintain a lower bound of 4.55% on interest rates.

My best speculation is that the Fed is going to keep tightening until the economy is done burning off this excess of supply (Milton Friedman's "fool in the shower" metaphor). When the markets finally hit the wall, the crash is going to be absolutely spectacular.