Yesterday the Bank of England (BoE) intervened in their government bond market to help prevent pension funds that were over-leveraged from “mass defaults”.

UK bonds (known as Gilts), especially the long bond, had screamed higher over the past week.

When the interest rate rises, bonds see their value go down. Investopedia has a decent write-up on how bonds work.

The market prices bonds based on their particular characteristics. A bond's price changes on a daily basis, just like that of any other publicly traded security, where supply and demand at any given moment determine that observed price.

The price of a bond changes in response to changes in interest rates in the economy. This is due to the fact that for a fixed-rate bond, the issuer has promised to pay a coupon based on the face value of the bond—so for a $1,000 par, 10% annual coupon bond, the issuer will pay the bondholder $100 each year.

Likewise, if interest rates soared to 15%, then an investor could make $150 from the government bond and would not pay $1,000 to earn just $100. This bond would be sold until it reached a price that equalized the yields, in this case to a price of $666.67.

Now add leverage on a losing bet. This is where pension funds were at. They had gotten themselves into trouble by borrowing funds to buy government bonds. This is the same playbook that Long Term Capital Management (LTCM) used until they blew-up in 1998.

Many have called this a “Lehman” moment but I think the comparison to LTCM is more apt. Lehman Brothers’ downfall was tied to their own malfeasance, especially when it came to the subprime mortgage crisis. They held large positions in subprime rated mortgage tranches. They weren’t necessarily over-leveraged, they just held risky bets that failed.

The BoE has now thrown gas on a fire hoping to put it out. It is engaged in is a risky situation. They have a depreciating currency, high inflation, and now they are intervening in a QE-style government bond buying spree to save these pension funds. This action by the BoE is a band-aid when a tourniquet was called for. This goes to show that central banks will sacrifice stocks and citizens to keep government bonds together. Don’t expect this to be limited to England. I expect to see more than a few funds blow up before a Powell pivot.

Earlier this week I had said that Powell’s plan was working. I also said that he was doing the bidding of the big NY banks and private equity firms (PE). We’ve had two important chances to peek behind the curtain concerning these big NY banks and PE firms. The first one was an exchange between Rep. Tlaib and JPMorgan CEO Jamie Dimon.

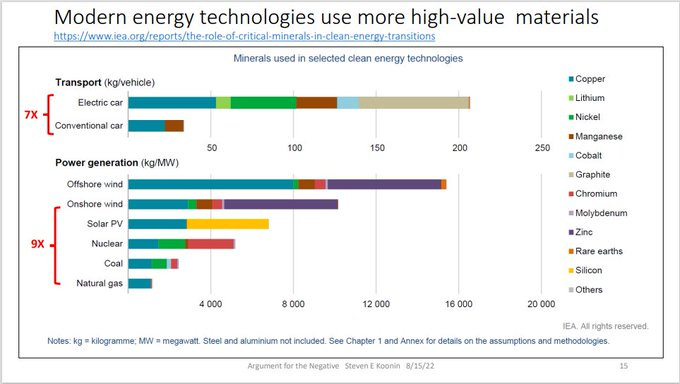

Mr Dimon knows that ESG is garbage. The goals of the “green” movement do not fit reality. Dimon knows that cutting off fossil fuels would “be the road to hell for America”. Energy is the lifeblood of the economy. Without energy, products do not get made or shipped. Dimon does a bang-up job explaining what exactly is needed to transition smoothly.

What ESG proponents miss (probably on purpose) is that fossil fuels are going to be needed to mine the essential elements out of the ground for their fancy zero-carbon solutions. Dimon is a smart guy. He knows this. He also knows that we are moving backwards towards coal when we should be moving forwards towards natural gas and nuclear power.

I expect that JPM is investing what it can into the energy sector. Congress and the Biden administration has done it’s best to prevent these energy companies from securing funds from traditional sources like these big NY banks. So my ears really perked up when I heard who is funding these projects now.

“Private Equity groups are becoming large financiers of fossil fuels as big banks wind down hydrocarbon investment.

The 10 largest private equity funds have 80% of their energy investments in fossil fuels.”

According to the nonprofit groups, the PE firms, which include Apollo Global Management, Blackstone Group, Brookfield Asset Management, Carlyle Group, KKR and Warbug Pincus, collectively oversee $216 billion worth of fossil-fuel assets--on par with the amount of money that big banks put into fossil fuels last year.

It looks like PE firms are dumping tech companies to pick up energy companies. There is a big rotation going on here and it is getting missed by the mainstream financial press. The reason that energy companies look so appealing to these PE firms is that the amount of free cash flow that is getting generated at many of these companies is nothing short of amazing. Policymakers have been trying to get rid of these energy companies, so why should they bother to invest in new developments? Instead, they are looking to pay dividends and buyback stock with their massive free cash flow. Under-investment in the industry is creating some amazing opportunities. Demand is increasing while supply is limited. We are seeing this play out across a wide swath of industries such as coal, oil, gas, copper. I anticipate that many of the smaller, highly efficient businesses are going to get snatched up by these PE firms and taken private.

I have been dying for your explanation. Thank you!!!!

Makes you wonder how much leverage is lurking right under the surface in other countries on the verge of blowing up in the next few months? Now that BOE broke the ice, how many more times will they do it, and how many other central banks will follow? Will any country step up and try to do something responsible on the government spending side?