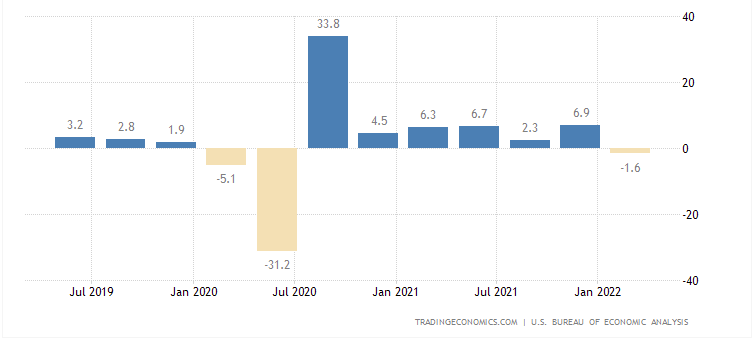

While I have expressed my disdain for the GDP calculation in the past, it continues to be the metric by which the mainstream press gauges whether the economy is contracting or not. The latest revision to the GDP dropped this morning and it continues to confirm what I have been warning about since December, a recession is in the cards and the early indicators continue to prove it. Here is the past three years’ worth of GDP data:

Our earliest recession indicator was when the 10-2 year treasury yield went negative. This happened on April 1 and the spread has continued to be mired around 0. It is currently yielding 10 basis points.

With the Fed’s balance sheet reduction program (Quantitative Tightening or QT), the bond market will continue to be in turmoil. A big buyer of treasuries has now become a seller. The big question for the Fed is, how high might rates go before they cry uncle? The 10 year is pushing 3.2% and the 5 year 3.25%. Will the Fed be able to ride to the rescue and restart QE? What if inflation hasn’t been tamed, might they say that their hands are tied and let the Biden administration go down with the ship?

As long as the Fed continues on the path of rate hikes, the dollar is going to strengthen. This translates to a weak market for silver, oil, gold, as well as exporters. At the same time, we’ve seen importers warn of excessive inventories due to consumers being tapped out. I believe that we will see some great bargains in the stock market soon, it makes me very excited on the work I am doing building a portfolio. Admittedly it is taking much longer than I expected but I am hopeful to have something soon. At this time, I remain a big bear on the market as a whole and unprofitable tech especially. I think patience is key here.

I think people can wonder why central banks need to talk now, and clearly they need to talk because they need to coordinate and the only thing that warrants that would be disorderly changes in exchange rates and presenting a united front of "not our fault".

Coordinating inflation rates means no dramatic drops in respective currencies, and no sudden adverse impact on exports. The meeting to me suggests that the plan going forward is a controlled devaluation by all, which is the only way out really anyway.

Where it may break is the euro, as the ecb doesn't have a secret weapon to control the yields on italian debt and as the italians are individually wealthy, the other countries will be unwilling to fund the borrowing of the italian state while they don't raise enough taxes.

Whether the plan to coordinate works or not we will see, but thats definitely the plan imho.