Today is day two on the hill for Fed Chair Jay Powell and Treasury Secretary Yellen. It is playing out similarly to yesterday. Expect there to be an acceleration of the taper. The next FOMC meeting is December 14-15. After this meeting a press conference will be held where economic projections from the Fed will be released. Typically these are pretty rosy. I’m not convinced this will play out the same as previous releases. Expect there to be an announcement of an increase in the reduction of asset purchases by the Fed at the press conference after the meeting.

The market may have priced in a slight increase. However, I expect the market and gold to sell off on that day (December 15th). In addition, the dollar will rally. This would be the standard playbook for traders with that kind of an announcement. If the Fed decides to stay the course, the opposite should play out.

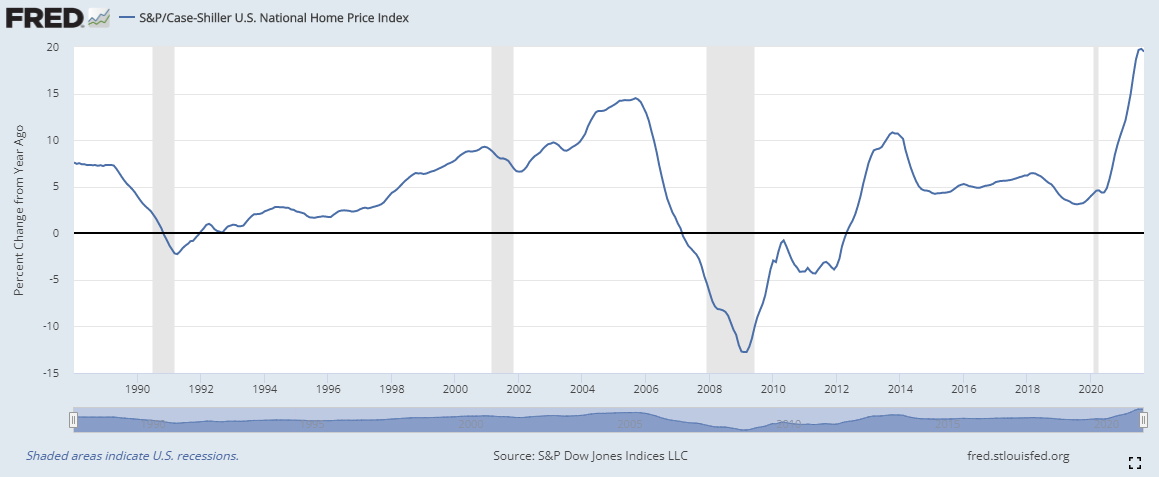

Yesterday saw the release of my favorite inflation indicator, the Case-Shiller home price index. I won’t rehash why I find this bit of information so insightful to forward inflation, so as not to bore you. You can find that background here, here, and here.

The index has pulled back slightly. It is down to a 19.5% year-over-year increase. This is a drop from last month’s record 19.8%. The latest data is from September. The index is two months delayed. The real estate market has been red hot for well over a year now. I expect a pause before a second wave could hit the property market. Of course the second wave could be stifled if a recession takes place.

A recession is traditionally defined as a slow down in economic activity. This is usually due to a slow down in spending. This is why the money supply figures are so important. When the supply of money slows, spending slows, which leads to reduced economic activity, aka a recession.

This is not a warning of an imminent recession. While a recession is looming due to the Fed’s reckless actions, the current indicators don’t point to it happening immediately. However, the bond market is pricing in a serious mistake by the Fed. I touched on this briefly yesterday. The bond market is continuing to flatten. Today saw the continuation of this trend. Long bonds are dropping while short bonds are rising. In time this will make it very difficult for banks to make money on their loan portfolios. Once this begins to take place, a recession will be in the cards.

![[Image - 169432] | MOAR | Know Your Meme [Image - 169432] | MOAR | Know Your Meme](https://substackcdn.com/image/fetch/$s_!XU22!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc3d2c338-a10f-4582-b0e7-341a1e82a3dc_463x282.gif)